Bitcoin Price Prediction Using Machine Learning Algorithms Article Swipe

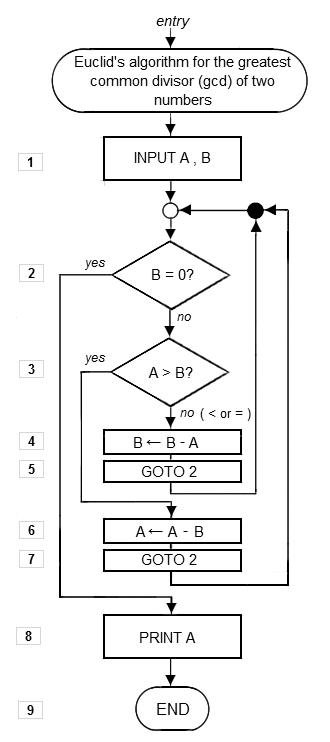

The rising popularity of cryptocurrencies has led to increased interest in predicting their prices, particularly in the case of Bitcoin due to its volatility and complexity. While past research has used machine learning to improve Bitcoin price prediction accuracy, there has been limited focus on exploring diverse modeling techniques for datasets with varying structures and dimensions. This study aims to forecast Bitcoin prices using machine learning techniques by categorizing them into daily prices and high-frequency prices. The project specifically employs the Random Forest Classifier algorithm to predict Bitcoin prices using historical data from July 2010 to May 2023. The dataset undergoes preprocessing and feature engineering to extract relevant features for the model. The trained algorithm is then optimized through hyperparameter tuning. Additionally, a simulation dashboard is created using Flask, a popular web framework, to allow users to evaluate different machine learning algorithms for predicting Bitcoin prices. The results of the project demonstrate that the Random Forest Classifier algorithm achieved 99% accuracy in predicting Bitcoin prices, highlighting the effectiveness of machine learning techniques in this context.

Related Topics

- Type

- preprint

- Language

- en

- Landing Page

- https://doi.org/10.21203/rs.3.rs-5801301/v1

- OA Status

- gold

- Cited By

- 1

- References

- 3

- Related Works

- 10

- OpenAlex ID

- https://openalex.org/W4406825334

Raw OpenAlex JSON

- OpenAlex ID

-

https://openalex.org/W4406825334Canonical identifier for this work in OpenAlex

- DOI

-

https://doi.org/10.21203/rs.3.rs-5801301/v1Digital Object Identifier

- Title

-

Bitcoin Price Prediction Using Machine Learning AlgorithmsWork title

- Type

-

preprintOpenAlex work type

- Language

-

enPrimary language

- Publication year

-

2025Year of publication

- Publication date

-

2025-01-25Full publication date if available

- Authors

-

Rohit PandeyList of authors in order

- Landing page

-

https://doi.org/10.21203/rs.3.rs-5801301/v1Publisher landing page

- Open access

-

YesWhether a free full text is available

- OA status

-

goldOpen access status per OpenAlex

- OA URL

-

https://doi.org/10.21203/rs.3.rs-5801301/v1Direct OA link when available

- Concepts

-

Computer science, Machine learning, Artificial intelligence, AlgorithmTop concepts (fields/topics) attached by OpenAlex

- Cited by

-

1Total citation count in OpenAlex

- Citations by year (recent)

-

2025: 1Per-year citation counts (last 5 years)

- References (count)

-

3Number of works referenced by this work

- Related works (count)

-

10Other works algorithmically related by OpenAlex

Full payload

| id | https://openalex.org/W4406825334 |

|---|---|

| doi | https://doi.org/10.21203/rs.3.rs-5801301/v1 |

| ids.doi | https://doi.org/10.21203/rs.3.rs-5801301/v1 |

| ids.openalex | https://openalex.org/W4406825334 |

| fwci | 5.50682111 |

| type | preprint |

| title | Bitcoin Price Prediction Using Machine Learning Algorithms |

| biblio.issue | |

| biblio.volume | |

| biblio.last_page | |

| biblio.first_page | |

| topics[0].id | https://openalex.org/T11326 |

| topics[0].field.id | https://openalex.org/fields/18 |

| topics[0].field.display_name | Decision Sciences |

| topics[0].score | 0.9688000082969666 |

| topics[0].domain.id | https://openalex.org/domains/2 |

| topics[0].domain.display_name | Social Sciences |

| topics[0].subfield.id | https://openalex.org/subfields/1803 |

| topics[0].subfield.display_name | Management Science and Operations Research |

| topics[0].display_name | Stock Market Forecasting Methods |

| topics[1].id | https://openalex.org/T14351 |

| topics[1].field.id | https://openalex.org/fields/17 |

| topics[1].field.display_name | Computer Science |

| topics[1].score | 0.9538999795913696 |

| topics[1].domain.id | https://openalex.org/domains/3 |

| topics[1].domain.display_name | Physical Sciences |

| topics[1].subfield.id | https://openalex.org/subfields/1702 |

| topics[1].subfield.display_name | Artificial Intelligence |

| topics[1].display_name | Statistical and Computational Modeling |

| topics[2].id | https://openalex.org/T11059 |

| topics[2].field.id | https://openalex.org/fields/20 |

| topics[2].field.display_name | Economics, Econometrics and Finance |

| topics[2].score | 0.9412999749183655 |

| topics[2].domain.id | https://openalex.org/domains/2 |

| topics[2].domain.display_name | Social Sciences |

| topics[2].subfield.id | https://openalex.org/subfields/2002 |

| topics[2].subfield.display_name | Economics and Econometrics |

| topics[2].display_name | Market Dynamics and Volatility |

| is_xpac | False |

| apc_list | |

| apc_paid | |

| concepts[0].id | https://openalex.org/C41008148 |

| concepts[0].level | 0 |

| concepts[0].score | 0.6014312505722046 |

| concepts[0].wikidata | https://www.wikidata.org/wiki/Q21198 |

| concepts[0].display_name | Computer science |

| concepts[1].id | https://openalex.org/C119857082 |

| concepts[1].level | 1 |

| concepts[1].score | 0.5442100763320923 |

| concepts[1].wikidata | https://www.wikidata.org/wiki/Q2539 |

| concepts[1].display_name | Machine learning |

| concepts[2].id | https://openalex.org/C154945302 |

| concepts[2].level | 1 |

| concepts[2].score | 0.4684830904006958 |

| concepts[2].wikidata | https://www.wikidata.org/wiki/Q11660 |

| concepts[2].display_name | Artificial intelligence |

| concepts[3].id | https://openalex.org/C11413529 |

| concepts[3].level | 1 |

| concepts[3].score | 0.42626330256462097 |

| concepts[3].wikidata | https://www.wikidata.org/wiki/Q8366 |

| concepts[3].display_name | Algorithm |

| keywords[0].id | https://openalex.org/keywords/computer-science |

| keywords[0].score | 0.6014312505722046 |

| keywords[0].display_name | Computer science |

| keywords[1].id | https://openalex.org/keywords/machine-learning |

| keywords[1].score | 0.5442100763320923 |

| keywords[1].display_name | Machine learning |

| keywords[2].id | https://openalex.org/keywords/artificial-intelligence |

| keywords[2].score | 0.4684830904006958 |

| keywords[2].display_name | Artificial intelligence |

| keywords[3].id | https://openalex.org/keywords/algorithm |

| keywords[3].score | 0.42626330256462097 |

| keywords[3].display_name | Algorithm |

| language | en |

| locations[0].id | doi:10.21203/rs.3.rs-5801301/v1 |

| locations[0].is_oa | True |

| locations[0].source | |

| locations[0].license | cc-by |

| locations[0].pdf_url | |

| locations[0].version | acceptedVersion |

| locations[0].raw_type | posted-content |

| locations[0].license_id | https://openalex.org/licenses/cc-by |

| locations[0].is_accepted | True |

| locations[0].is_published | False |

| locations[0].raw_source_name | |

| locations[0].landing_page_url | https://doi.org/10.21203/rs.3.rs-5801301/v1 |

| indexed_in | crossref |

| authorships[0].author.id | https://openalex.org/A5102811556 |

| authorships[0].author.orcid | https://orcid.org/0000-0001-5142-6130 |

| authorships[0].author.display_name | Rohit Pandey |

| authorships[0].affiliations[0].raw_affiliation_string | Government Polytechnic College Betul M.P. India |

| authorships[0].author_position | first |

| authorships[0].raw_author_name | RITESH PANDEY |

| authorships[0].is_corresponding | True |

| authorships[0].raw_affiliation_strings | Government Polytechnic College Betul M.P. India |

| has_content.pdf | False |

| has_content.grobid_xml | False |

| is_paratext | False |

| open_access.is_oa | True |

| open_access.oa_url | https://doi.org/10.21203/rs.3.rs-5801301/v1 |

| open_access.oa_status | gold |

| open_access.any_repository_has_fulltext | False |

| created_date | 2025-10-10T00:00:00 |

| display_name | Bitcoin Price Prediction Using Machine Learning Algorithms |

| has_fulltext | False |

| is_retracted | False |

| updated_date | 2025-11-06T03:46:38.306776 |

| primary_topic.id | https://openalex.org/T11326 |

| primary_topic.field.id | https://openalex.org/fields/18 |

| primary_topic.field.display_name | Decision Sciences |

| primary_topic.score | 0.9688000082969666 |

| primary_topic.domain.id | https://openalex.org/domains/2 |

| primary_topic.domain.display_name | Social Sciences |

| primary_topic.subfield.id | https://openalex.org/subfields/1803 |

| primary_topic.subfield.display_name | Management Science and Operations Research |

| primary_topic.display_name | Stock Market Forecasting Methods |

| related_works | https://openalex.org/W2961085424, https://openalex.org/W4306674287, https://openalex.org/W4387369504, https://openalex.org/W3046775127, https://openalex.org/W4394896187, https://openalex.org/W3170094116, https://openalex.org/W4386462264, https://openalex.org/W3107602296, https://openalex.org/W4364306694, https://openalex.org/W4312192474 |

| cited_by_count | 1 |

| counts_by_year[0].year | 2025 |

| counts_by_year[0].cited_by_count | 1 |

| locations_count | 1 |

| best_oa_location.id | doi:10.21203/rs.3.rs-5801301/v1 |

| best_oa_location.is_oa | True |

| best_oa_location.source | |

| best_oa_location.license | cc-by |

| best_oa_location.pdf_url | |

| best_oa_location.version | acceptedVersion |

| best_oa_location.raw_type | posted-content |

| best_oa_location.license_id | https://openalex.org/licenses/cc-by |

| best_oa_location.is_accepted | True |

| best_oa_location.is_published | False |

| best_oa_location.raw_source_name | |

| best_oa_location.landing_page_url | https://doi.org/10.21203/rs.3.rs-5801301/v1 |

| primary_location.id | doi:10.21203/rs.3.rs-5801301/v1 |

| primary_location.is_oa | True |

| primary_location.source | |

| primary_location.license | cc-by |

| primary_location.pdf_url | |

| primary_location.version | acceptedVersion |

| primary_location.raw_type | posted-content |

| primary_location.license_id | https://openalex.org/licenses/cc-by |

| primary_location.is_accepted | True |

| primary_location.is_published | False |

| primary_location.raw_source_name | |

| primary_location.landing_page_url | https://doi.org/10.21203/rs.3.rs-5801301/v1 |

| publication_date | 2025-01-25 |

| publication_year | 2025 |

| referenced_works | https://openalex.org/W6959738739, https://openalex.org/W3131454301, https://openalex.org/W4250926398 |

| referenced_works_count | 3 |

| abstract_inverted_index.a | 123, 130 |

| abstract_inverted_index.by | 68 |

| abstract_inverted_index.in | 11, 16, 162, 173 |

| abstract_inverted_index.is | 116, 126 |

| abstract_inverted_index.of | 4, 19, 149, 169 |

| abstract_inverted_index.on | 45 |

| abstract_inverted_index.to | 8, 22, 34, 60, 86, 96, 106, 134, 137 |

| abstract_inverted_index.99% | 160 |

| abstract_inverted_index.May | 97 |

| abstract_inverted_index.The | 1, 77, 99, 113, 147 |

| abstract_inverted_index.and | 25, 55, 74, 103 |

| abstract_inverted_index.due | 21 |

| abstract_inverted_index.for | 50, 110, 143 |

| abstract_inverted_index.has | 6, 30, 41 |

| abstract_inverted_index.its | 23 |

| abstract_inverted_index.led | 7 |

| abstract_inverted_index.the | 17, 81, 111, 150, 154, 167 |

| abstract_inverted_index.web | 132 |

| abstract_inverted_index.2010 | 95 |

| abstract_inverted_index.July | 94 |

| abstract_inverted_index.This | 57 |

| abstract_inverted_index.aims | 59 |

| abstract_inverted_index.been | 42 |

| abstract_inverted_index.case | 18 |

| abstract_inverted_index.data | 92 |

| abstract_inverted_index.from | 93 |

| abstract_inverted_index.into | 71 |

| abstract_inverted_index.past | 28 |

| abstract_inverted_index.that | 153 |

| abstract_inverted_index.them | 70 |

| abstract_inverted_index.then | 117 |

| abstract_inverted_index.this | 174 |

| abstract_inverted_index.used | 31 |

| abstract_inverted_index.with | 52 |

| abstract_inverted_index.2023. | 98 |

| abstract_inverted_index.While | 27 |

| abstract_inverted_index.allow | 135 |

| abstract_inverted_index.daily | 72 |

| abstract_inverted_index.focus | 44 |

| abstract_inverted_index.price | 37 |

| abstract_inverted_index.study | 58 |

| abstract_inverted_index.their | 13 |

| abstract_inverted_index.there | 40 |

| abstract_inverted_index.users | 136 |

| abstract_inverted_index.using | 64, 90, 128 |

| abstract_inverted_index.Flask, | 129 |

| abstract_inverted_index.Forest | 83, 156 |

| abstract_inverted_index.Random | 82, 155 |

| abstract_inverted_index.model. | 112 |

| abstract_inverted_index.prices | 63, 73, 89 |

| abstract_inverted_index.rising | 2 |

| abstract_inverted_index.Bitcoin | 20, 36, 62, 88, 145, 164 |

| abstract_inverted_index.created | 127 |

| abstract_inverted_index.dataset | 100 |

| abstract_inverted_index.diverse | 47 |

| abstract_inverted_index.employs | 80 |

| abstract_inverted_index.extract | 107 |

| abstract_inverted_index.feature | 104 |

| abstract_inverted_index.improve | 35 |

| abstract_inverted_index.limited | 43 |

| abstract_inverted_index.machine | 32, 65, 140, 170 |

| abstract_inverted_index.popular | 131 |

| abstract_inverted_index.predict | 87 |

| abstract_inverted_index.prices, | 14, 165 |

| abstract_inverted_index.prices. | 76, 146 |

| abstract_inverted_index.project | 78, 151 |

| abstract_inverted_index.results | 148 |

| abstract_inverted_index.through | 119 |

| abstract_inverted_index.trained | 114 |

| abstract_inverted_index.tuning. | 121 |

| abstract_inverted_index.varying | 53 |

| abstract_inverted_index.accuracy | 161 |

| abstract_inverted_index.achieved | 159 |

| abstract_inverted_index.context. | 175 |

| abstract_inverted_index.datasets | 51 |

| abstract_inverted_index.evaluate | 138 |

| abstract_inverted_index.features | 109 |

| abstract_inverted_index.forecast | 61 |

| abstract_inverted_index.interest | 10 |

| abstract_inverted_index.learning | 33, 66, 141, 171 |

| abstract_inverted_index.modeling | 48 |

| abstract_inverted_index.relevant | 108 |

| abstract_inverted_index.research | 29 |

| abstract_inverted_index.accuracy, | 39 |

| abstract_inverted_index.algorithm | 85, 115, 158 |

| abstract_inverted_index.dashboard | 125 |

| abstract_inverted_index.different | 139 |

| abstract_inverted_index.exploring | 46 |

| abstract_inverted_index.increased | 9 |

| abstract_inverted_index.optimized | 118 |

| abstract_inverted_index.undergoes | 101 |

| abstract_inverted_index.Classifier | 84, 157 |

| abstract_inverted_index.algorithms | 142 |

| abstract_inverted_index.framework, | 133 |

| abstract_inverted_index.historical | 91 |

| abstract_inverted_index.popularity | 3 |

| abstract_inverted_index.predicting | 12, 144, 163 |

| abstract_inverted_index.prediction | 38 |

| abstract_inverted_index.simulation | 124 |

| abstract_inverted_index.structures | 54 |

| abstract_inverted_index.techniques | 49, 67, 172 |

| abstract_inverted_index.volatility | 24 |

| abstract_inverted_index.complexity. | 26 |

| abstract_inverted_index.demonstrate | 152 |

| abstract_inverted_index.dimensions. | 56 |

| abstract_inverted_index.engineering | 105 |

| abstract_inverted_index.categorizing | 69 |

| abstract_inverted_index.highlighting | 166 |

| abstract_inverted_index.particularly | 15 |

| abstract_inverted_index.specifically | 79 |

| abstract_inverted_index.Additionally, | 122 |

| abstract_inverted_index.effectiveness | 168 |

| abstract_inverted_index.preprocessing | 102 |

| abstract_inverted_index.high-frequency | 75 |

| abstract_inverted_index.hyperparameter | 120 |

| abstract_inverted_index.cryptocurrencies | 5 |

| abstract_inverted_index.<title>Abstract</title> | 0 |

| cited_by_percentile_year.max | 95 |

| cited_by_percentile_year.min | 91 |

| corresponding_author_ids | https://openalex.org/A5102811556 |

| countries_distinct_count | 0 |

| institutions_distinct_count | 1 |

| citation_normalized_percentile.value | 0.86822318 |

| citation_normalized_percentile.is_in_top_1_percent | False |

| citation_normalized_percentile.is_in_top_10_percent | True |