Capital Structure Article Swipe

YOU?

·

· 2023

· Open Access

·

· DOI: https://doi.org/10.1007/978-3-031-35009-2_15

· OA: W4386724098

YOU?

·

· 2023

· Open Access

·

· DOI: https://doi.org/10.1007/978-3-031-35009-2_15

· OA: W4386724098

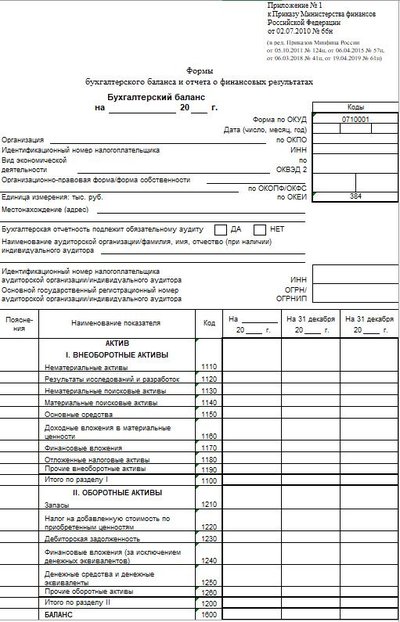

Capital structure is about the funding side of the company’s balance sheet and enables a better understanding of a company’s risk profile and health. We start from financial capital structure, which concerns the proportions of debt and equity in proportion to each other and the company’s asset base. These can be expressed in ratios such as debt/assets. We then consider theories that explain financial capital structure, such as the Modigliani-Miller (MM) theorems. Subsequently, we consider the capital structures of environmental (E) and social (S) separately. Companies generate assets and liabilities on E and S, as they do on the financial side. The main difference is that it is typically much less clear how strong the claims against the company are, and to what extent they will materialise in financial terms. However, their presence and size give strong indications of additional risk. The analysis of the capital structures of E and S allows us to take the next step, namely the construction of an integrated capital structure, which is the capital structure of F, E, and S combined. As found in Chap. 13 on the cost of integrated capital, liabilities on S and E can make the integrated capital structure riskier than the financial capital structure and raise the cost of integrated capital.