Credit rating algorithm of corporate bonds based on Gaussian process mixture model and improved K-means Article Swipe

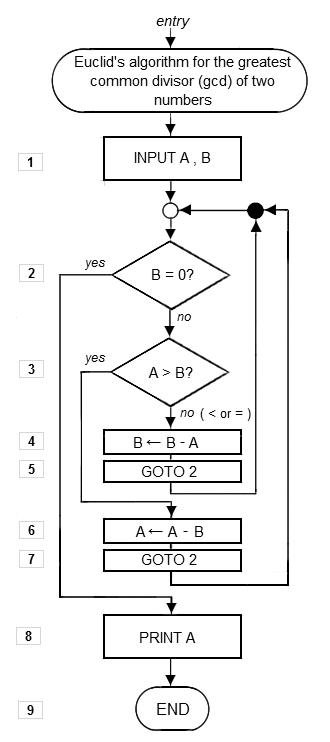

The primary challenge in credit analysis revolves around uncovering the correlation between repayment terms and yield to maturity, constituting the interest rate term structure-an essential model for corporate credit term evaluation. Presently, interest rate term structures are predominantly examined through economic theoretical models and quantitative models. However, predicting treasury bond yields remains a challenging task for both approaches. Leveraging the clustering analysis algorithm theory and the attributes of an insurance company’s customer database, this paper enhances the K-means clustering algorithm, specifically addressing the selection of initial cluster centers in extensive sample environments. Utilizing the robust data fitting and analytical capabilities of the Gaussian process mixture model, the study applies this methodology to model and forecast Treasury yields. Additionally, the research incorporates customer credit data from a property insurance company to investigate the application of clustering algorithms in the analysis of insurance customer credit.

Related Topics

- Type

- article

- Language

- en

- Landing Page

- https://doi.org/10.61091/jcmcc117-14

- https://combinatorialpress.com/article/jcmcc/Credit-rating-algorithm-of-corporate-bonds-based-on-Gaussian-process-mixture-model-and-improved-K-means.pdf

- OA Status

- hybrid

- References

- 22

- Related Works

- 10

- OpenAlex ID

- https://openalex.org/W4391127761

Raw OpenAlex JSON

- OpenAlex ID

-

https://openalex.org/W4391127761Canonical identifier for this work in OpenAlex

- DOI

-

https://doi.org/10.61091/jcmcc117-14Digital Object Identifier

- Title

-

Credit rating algorithm of corporate bonds based on Gaussian process mixture model and improved K-meansWork title

- Type

-

articleOpenAlex work type

- Language

-

enPrimary language

- Publication year

-

2023Year of publication

- Publication date

-

2023-12-31Full publication date if available

- Authors

-

Wenzhong XiaList of authors in order

- Landing page

-

https://doi.org/10.61091/jcmcc117-14Publisher landing page

- PDF URL

-

https://combinatorialpress.com/article/jcmcc/Credit-rating-algorithm-of-corporate-bonds-based-on-Gaussian-process-mixture-model-and-improved-K-means.pdfDirect link to full text PDF

- Open access

-

YesWhether a free full text is available

- OA status

-

hybridOpen access status per OpenAlex

- OA URL

-

https://combinatorialpress.com/article/jcmcc/Credit-rating-algorithm-of-corporate-bonds-based-on-Gaussian-process-mixture-model-and-improved-K-means.pdfDirect OA link when available

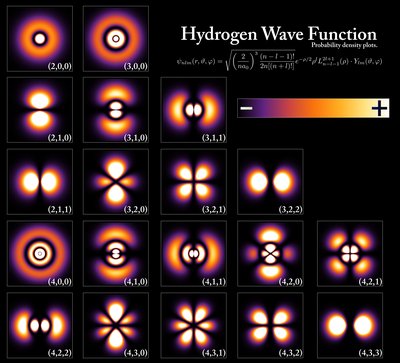

- Concepts

-

Cluster analysis, Treasury, Computer science, Credit rating, Data mining, Credit risk, Term (time), Econometrics, Algorithm, Artificial intelligence, Finance, Economics, Archaeology, Physics, Quantum mechanics, HistoryTop concepts (fields/topics) attached by OpenAlex

- Cited by

-

0Total citation count in OpenAlex

- References (count)

-

22Number of works referenced by this work

- Related works (count)

-

10Other works algorithmically related by OpenAlex

Full payload

| id | https://openalex.org/W4391127761 |

|---|---|

| doi | https://doi.org/10.61091/jcmcc117-14 |

| ids.doi | https://doi.org/10.61091/jcmcc117-14 |

| ids.openalex | https://openalex.org/W4391127761 |

| fwci | 0.0 |

| type | article |

| title | Credit rating algorithm of corporate bonds based on Gaussian process mixture model and improved K-means |

| biblio.issue | |

| biblio.volume | 117 |

| biblio.last_page | 168 |

| biblio.first_page | 159 |

| topics[0].id | https://openalex.org/T13702 |

| topics[0].field.id | https://openalex.org/fields/17 |

| topics[0].field.display_name | Computer Science |

| topics[0].score | 0.9750000238418579 |

| topics[0].domain.id | https://openalex.org/domains/3 |

| topics[0].domain.display_name | Physical Sciences |

| topics[0].subfield.id | https://openalex.org/subfields/1702 |

| topics[0].subfield.display_name | Artificial Intelligence |

| topics[0].display_name | Machine Learning in Healthcare |

| is_xpac | False |

| apc_list | |

| apc_paid | |

| concepts[0].id | https://openalex.org/C73555534 |

| concepts[0].level | 2 |

| concepts[0].score | 0.7328540086746216 |

| concepts[0].wikidata | https://www.wikidata.org/wiki/Q622825 |

| concepts[0].display_name | Cluster analysis |

| concepts[1].id | https://openalex.org/C2780889827 |

| concepts[1].level | 2 |

| concepts[1].score | 0.7041009068489075 |

| concepts[1].wikidata | https://www.wikidata.org/wiki/Q10756188 |

| concepts[1].display_name | Treasury |

| concepts[2].id | https://openalex.org/C41008148 |

| concepts[2].level | 0 |

| concepts[2].score | 0.5473525524139404 |

| concepts[2].wikidata | https://www.wikidata.org/wiki/Q21198 |

| concepts[2].display_name | Computer science |

| concepts[3].id | https://openalex.org/C205208723 |

| concepts[3].level | 2 |

| concepts[3].score | 0.5471609234809875 |

| concepts[3].wikidata | https://www.wikidata.org/wiki/Q372765 |

| concepts[3].display_name | Credit rating |

| concepts[4].id | https://openalex.org/C124101348 |

| concepts[4].level | 1 |

| concepts[4].score | 0.47771573066711426 |

| concepts[4].wikidata | https://www.wikidata.org/wiki/Q172491 |

| concepts[4].display_name | Data mining |

| concepts[5].id | https://openalex.org/C178350159 |

| concepts[5].level | 2 |

| concepts[5].score | 0.46910032629966736 |

| concepts[5].wikidata | https://www.wikidata.org/wiki/Q162714 |

| concepts[5].display_name | Credit risk |

| concepts[6].id | https://openalex.org/C61797465 |

| concepts[6].level | 2 |

| concepts[6].score | 0.4460059404373169 |

| concepts[6].wikidata | https://www.wikidata.org/wiki/Q1188986 |

| concepts[6].display_name | Term (time) |

| concepts[7].id | https://openalex.org/C149782125 |

| concepts[7].level | 1 |

| concepts[7].score | 0.37077680230140686 |

| concepts[7].wikidata | https://www.wikidata.org/wiki/Q160039 |

| concepts[7].display_name | Econometrics |

| concepts[8].id | https://openalex.org/C11413529 |

| concepts[8].level | 1 |

| concepts[8].score | 0.361091673374176 |

| concepts[8].wikidata | https://www.wikidata.org/wiki/Q8366 |

| concepts[8].display_name | Algorithm |

| concepts[9].id | https://openalex.org/C154945302 |

| concepts[9].level | 1 |

| concepts[9].score | 0.28275346755981445 |

| concepts[9].wikidata | https://www.wikidata.org/wiki/Q11660 |

| concepts[9].display_name | Artificial intelligence |

| concepts[10].id | https://openalex.org/C10138342 |

| concepts[10].level | 1 |

| concepts[10].score | 0.2628021240234375 |

| concepts[10].wikidata | https://www.wikidata.org/wiki/Q43015 |

| concepts[10].display_name | Finance |

| concepts[11].id | https://openalex.org/C162324750 |

| concepts[11].level | 0 |

| concepts[11].score | 0.20100364089012146 |

| concepts[11].wikidata | https://www.wikidata.org/wiki/Q8134 |

| concepts[11].display_name | Economics |

| concepts[12].id | https://openalex.org/C166957645 |

| concepts[12].level | 1 |

| concepts[12].score | 0.0 |

| concepts[12].wikidata | https://www.wikidata.org/wiki/Q23498 |

| concepts[12].display_name | Archaeology |

| concepts[13].id | https://openalex.org/C121332964 |

| concepts[13].level | 0 |

| concepts[13].score | 0.0 |

| concepts[13].wikidata | https://www.wikidata.org/wiki/Q413 |

| concepts[13].display_name | Physics |

| concepts[14].id | https://openalex.org/C62520636 |

| concepts[14].level | 1 |

| concepts[14].score | 0.0 |

| concepts[14].wikidata | https://www.wikidata.org/wiki/Q944 |

| concepts[14].display_name | Quantum mechanics |

| concepts[15].id | https://openalex.org/C95457728 |

| concepts[15].level | 0 |

| concepts[15].score | 0.0 |

| concepts[15].wikidata | https://www.wikidata.org/wiki/Q309 |

| concepts[15].display_name | History |

| keywords[0].id | https://openalex.org/keywords/cluster-analysis |

| keywords[0].score | 0.7328540086746216 |

| keywords[0].display_name | Cluster analysis |

| keywords[1].id | https://openalex.org/keywords/treasury |

| keywords[1].score | 0.7041009068489075 |

| keywords[1].display_name | Treasury |

| keywords[2].id | https://openalex.org/keywords/computer-science |

| keywords[2].score | 0.5473525524139404 |

| keywords[2].display_name | Computer science |

| keywords[3].id | https://openalex.org/keywords/credit-rating |

| keywords[3].score | 0.5471609234809875 |

| keywords[3].display_name | Credit rating |

| keywords[4].id | https://openalex.org/keywords/data-mining |

| keywords[4].score | 0.47771573066711426 |

| keywords[4].display_name | Data mining |

| keywords[5].id | https://openalex.org/keywords/credit-risk |

| keywords[5].score | 0.46910032629966736 |

| keywords[5].display_name | Credit risk |

| keywords[6].id | https://openalex.org/keywords/term |

| keywords[6].score | 0.4460059404373169 |

| keywords[6].display_name | Term (time) |

| keywords[7].id | https://openalex.org/keywords/econometrics |

| keywords[7].score | 0.37077680230140686 |

| keywords[7].display_name | Econometrics |

| keywords[8].id | https://openalex.org/keywords/algorithm |

| keywords[8].score | 0.361091673374176 |

| keywords[8].display_name | Algorithm |

| keywords[9].id | https://openalex.org/keywords/artificial-intelligence |

| keywords[9].score | 0.28275346755981445 |

| keywords[9].display_name | Artificial intelligence |

| keywords[10].id | https://openalex.org/keywords/finance |

| keywords[10].score | 0.2628021240234375 |

| keywords[10].display_name | Finance |

| keywords[11].id | https://openalex.org/keywords/economics |

| keywords[11].score | 0.20100364089012146 |

| keywords[11].display_name | Economics |

| language | en |

| locations[0].id | doi:10.61091/jcmcc117-14 |

| locations[0].is_oa | True |

| locations[0].source.id | https://openalex.org/S2764734251 |

| locations[0].source.issn | 0835-3026, 2817-576X |

| locations[0].source.type | journal |

| locations[0].source.is_oa | False |

| locations[0].source.issn_l | 0835-3026 |

| locations[0].source.is_core | True |

| locations[0].source.is_in_doaj | False |

| locations[0].source.display_name | Journal of Combinatorial Mathematics and Combinatorial Computing |

| locations[0].source.host_organization | |

| locations[0].source.host_organization_name | |

| locations[0].license | cc-by |

| locations[0].pdf_url | https://combinatorialpress.com/article/jcmcc/Credit-rating-algorithm-of-corporate-bonds-based-on-Gaussian-process-mixture-model-and-improved-K-means.pdf |

| locations[0].version | publishedVersion |

| locations[0].raw_type | journal-article |

| locations[0].license_id | https://openalex.org/licenses/cc-by |

| locations[0].is_accepted | True |

| locations[0].is_published | True |

| locations[0].raw_source_name | Journal of Combinatorial Mathematics and Combinatorial Computing |

| locations[0].landing_page_url | https://doi.org/10.61091/jcmcc117-14 |

| indexed_in | crossref |

| authorships[0].author.id | https://openalex.org/A5101142105 |

| authorships[0].author.orcid | |

| authorships[0].author.display_name | Wenzhong Xia |

| authorships[0].affiliations[0].raw_affiliation_string | School of Zhangjiakou Vocational and Technical College, Zhangjiakou 075000, China. |

| authorships[0].author_position | first |

| authorships[0].raw_author_name | Wenzhong Xia |

| authorships[0].is_corresponding | True |

| authorships[0].raw_affiliation_strings | School of Zhangjiakou Vocational and Technical College, Zhangjiakou 075000, China. |

| has_content.pdf | True |

| has_content.grobid_xml | True |

| is_paratext | False |

| open_access.is_oa | True |

| open_access.oa_url | https://combinatorialpress.com/article/jcmcc/Credit-rating-algorithm-of-corporate-bonds-based-on-Gaussian-process-mixture-model-and-improved-K-means.pdf |

| open_access.oa_status | hybrid |

| open_access.any_repository_has_fulltext | False |

| created_date | 2024-01-24T00:00:00 |

| display_name | Credit rating algorithm of corporate bonds based on Gaussian process mixture model and improved K-means |

| has_fulltext | True |

| is_retracted | False |

| updated_date | 2025-11-06T03:46:38.306776 |

| primary_topic.id | https://openalex.org/T13702 |

| primary_topic.field.id | https://openalex.org/fields/17 |

| primary_topic.field.display_name | Computer Science |

| primary_topic.score | 0.9750000238418579 |

| primary_topic.domain.id | https://openalex.org/domains/3 |

| primary_topic.domain.display_name | Physical Sciences |

| primary_topic.subfield.id | https://openalex.org/subfields/1702 |

| primary_topic.subfield.display_name | Artificial Intelligence |

| primary_topic.display_name | Machine Learning in Healthcare |

| related_works | https://openalex.org/W1589100136, https://openalex.org/W2890373187, https://openalex.org/W178814299, https://openalex.org/W2501839603, https://openalex.org/W1506380559, https://openalex.org/W2120860797, https://openalex.org/W4237804916, https://openalex.org/W2139130483, https://openalex.org/W3008010582, https://openalex.org/W2204573785 |

| cited_by_count | 0 |

| locations_count | 1 |

| best_oa_location.id | doi:10.61091/jcmcc117-14 |

| best_oa_location.is_oa | True |

| best_oa_location.source.id | https://openalex.org/S2764734251 |

| best_oa_location.source.issn | 0835-3026, 2817-576X |

| best_oa_location.source.type | journal |

| best_oa_location.source.is_oa | False |

| best_oa_location.source.issn_l | 0835-3026 |

| best_oa_location.source.is_core | True |

| best_oa_location.source.is_in_doaj | False |

| best_oa_location.source.display_name | Journal of Combinatorial Mathematics and Combinatorial Computing |

| best_oa_location.source.host_organization | |

| best_oa_location.source.host_organization_name | |

| best_oa_location.license | cc-by |

| best_oa_location.pdf_url | https://combinatorialpress.com/article/jcmcc/Credit-rating-algorithm-of-corporate-bonds-based-on-Gaussian-process-mixture-model-and-improved-K-means.pdf |

| best_oa_location.version | publishedVersion |

| best_oa_location.raw_type | journal-article |

| best_oa_location.license_id | https://openalex.org/licenses/cc-by |

| best_oa_location.is_accepted | True |

| best_oa_location.is_published | True |

| best_oa_location.raw_source_name | Journal of Combinatorial Mathematics and Combinatorial Computing |

| best_oa_location.landing_page_url | https://doi.org/10.61091/jcmcc117-14 |

| primary_location.id | doi:10.61091/jcmcc117-14 |

| primary_location.is_oa | True |

| primary_location.source.id | https://openalex.org/S2764734251 |

| primary_location.source.issn | 0835-3026, 2817-576X |

| primary_location.source.type | journal |

| primary_location.source.is_oa | False |

| primary_location.source.issn_l | 0835-3026 |

| primary_location.source.is_core | True |

| primary_location.source.is_in_doaj | False |

| primary_location.source.display_name | Journal of Combinatorial Mathematics and Combinatorial Computing |

| primary_location.source.host_organization | |

| primary_location.source.host_organization_name | |

| primary_location.license | cc-by |

| primary_location.pdf_url | https://combinatorialpress.com/article/jcmcc/Credit-rating-algorithm-of-corporate-bonds-based-on-Gaussian-process-mixture-model-and-improved-K-means.pdf |

| primary_location.version | publishedVersion |

| primary_location.raw_type | journal-article |

| primary_location.license_id | https://openalex.org/licenses/cc-by |

| primary_location.is_accepted | True |

| primary_location.is_published | True |

| primary_location.raw_source_name | Journal of Combinatorial Mathematics and Combinatorial Computing |

| primary_location.landing_page_url | https://doi.org/10.61091/jcmcc117-14 |

| publication_date | 2023-12-31 |

| publication_year | 2023 |

| referenced_works | https://openalex.org/W2295978047, https://openalex.org/W3036520662, https://openalex.org/W2746939825, https://openalex.org/W3173537256, https://openalex.org/W2112610675, https://openalex.org/W2116091691, https://openalex.org/W3042907808, https://openalex.org/W2965206452, https://openalex.org/W2113174146, https://openalex.org/W2902371880, https://openalex.org/W3045881740, https://openalex.org/W2894758925, https://openalex.org/W3010882522, https://openalex.org/W4230869460, https://openalex.org/W2216091599, https://openalex.org/W2996036738, https://openalex.org/W1969519932, https://openalex.org/W2969222270, https://openalex.org/W4321033361, https://openalex.org/W3201890445, https://openalex.org/W3046287038, https://openalex.org/W3046234331 |

| referenced_works_count | 22 |

| abstract_inverted_index.a | 52, 125 |

| abstract_inverted_index.an | 68 |

| abstract_inverted_index.in | 3, 88, 136 |

| abstract_inverted_index.of | 67, 84, 100, 133, 139 |

| abstract_inverted_index.to | 16, 111, 129 |

| abstract_inverted_index.The | 0 |

| abstract_inverted_index.and | 14, 43, 64, 97, 113 |

| abstract_inverted_index.are | 36 |

| abstract_inverted_index.for | 26, 55 |

| abstract_inverted_index.the | 9, 19, 59, 65, 76, 82, 93, 101, 106, 118, 131, 137 |

| abstract_inverted_index.bond | 49 |

| abstract_inverted_index.both | 56 |

| abstract_inverted_index.data | 95, 123 |

| abstract_inverted_index.from | 124 |

| abstract_inverted_index.rate | 21, 33 |

| abstract_inverted_index.task | 54 |

| abstract_inverted_index.term | 22, 29, 34 |

| abstract_inverted_index.this | 73, 109 |

| abstract_inverted_index.model | 25, 112 |

| abstract_inverted_index.paper | 74 |

| abstract_inverted_index.study | 107 |

| abstract_inverted_index.terms | 13 |

| abstract_inverted_index.yield | 15 |

| abstract_inverted_index.around | 7 |

| abstract_inverted_index.credit | 4, 28, 122 |

| abstract_inverted_index.model, | 105 |

| abstract_inverted_index.models | 42 |

| abstract_inverted_index.robust | 94 |

| abstract_inverted_index.sample | 90 |

| abstract_inverted_index.theory | 63 |

| abstract_inverted_index.yields | 50 |

| abstract_inverted_index.K-means | 77 |

| abstract_inverted_index.applies | 108 |

| abstract_inverted_index.between | 11 |

| abstract_inverted_index.centers | 87 |

| abstract_inverted_index.cluster | 86 |

| abstract_inverted_index.company | 128 |

| abstract_inverted_index.credit. | 142 |

| abstract_inverted_index.fitting | 96 |

| abstract_inverted_index.initial | 85 |

| abstract_inverted_index.mixture | 104 |

| abstract_inverted_index.models. | 45 |

| abstract_inverted_index.primary | 1 |

| abstract_inverted_index.process | 103 |

| abstract_inverted_index.remains | 51 |

| abstract_inverted_index.through | 39 |

| abstract_inverted_index.yields. | 116 |

| abstract_inverted_index.Gaussian | 102 |

| abstract_inverted_index.However, | 46 |

| abstract_inverted_index.Treasury | 115 |

| abstract_inverted_index.analysis | 5, 61, 138 |

| abstract_inverted_index.customer | 71, 121, 141 |

| abstract_inverted_index.economic | 40 |

| abstract_inverted_index.enhances | 75 |

| abstract_inverted_index.examined | 38 |

| abstract_inverted_index.forecast | 114 |

| abstract_inverted_index.interest | 20, 32 |

| abstract_inverted_index.property | 126 |

| abstract_inverted_index.research | 119 |

| abstract_inverted_index.revolves | 6 |

| abstract_inverted_index.treasury | 48 |

| abstract_inverted_index.Utilizing | 92 |

| abstract_inverted_index.algorithm | 62 |

| abstract_inverted_index.challenge | 2 |

| abstract_inverted_index.corporate | 27 |

| abstract_inverted_index.database, | 72 |

| abstract_inverted_index.essential | 24 |

| abstract_inverted_index.extensive | 89 |

| abstract_inverted_index.insurance | 69, 127, 140 |

| abstract_inverted_index.maturity, | 17 |

| abstract_inverted_index.repayment | 12 |

| abstract_inverted_index.selection | 83 |

| abstract_inverted_index.Leveraging | 58 |

| abstract_inverted_index.Presently, | 31 |

| abstract_inverted_index.addressing | 81 |

| abstract_inverted_index.algorithm, | 79 |

| abstract_inverted_index.algorithms | 135 |

| abstract_inverted_index.analytical | 98 |

| abstract_inverted_index.attributes | 66 |

| abstract_inverted_index.clustering | 60, 78, 134 |

| abstract_inverted_index.predicting | 47 |

| abstract_inverted_index.structures | 35 |

| abstract_inverted_index.uncovering | 8 |

| abstract_inverted_index.application | 132 |

| abstract_inverted_index.approaches. | 57 |

| abstract_inverted_index.challenging | 53 |

| abstract_inverted_index.company’s | 70 |

| abstract_inverted_index.correlation | 10 |

| abstract_inverted_index.evaluation. | 30 |

| abstract_inverted_index.investigate | 130 |

| abstract_inverted_index.methodology | 110 |

| abstract_inverted_index.theoretical | 41 |

| abstract_inverted_index.capabilities | 99 |

| abstract_inverted_index.constituting | 18 |

| abstract_inverted_index.incorporates | 120 |

| abstract_inverted_index.quantitative | 44 |

| abstract_inverted_index.specifically | 80 |

| abstract_inverted_index.structure-an | 23 |

| abstract_inverted_index.Additionally, | 117 |

| abstract_inverted_index.environments. | 91 |

| abstract_inverted_index.predominantly | 37 |

| cited_by_percentile_year | |

| corresponding_author_ids | https://openalex.org/A5101142105 |

| countries_distinct_count | 0 |

| institutions_distinct_count | 1 |

| citation_normalized_percentile.value | 0.22657076 |

| citation_normalized_percentile.is_in_top_1_percent | False |

| citation_normalized_percentile.is_in_top_10_percent | False |