Deposit Competition and Financial Fragility: Evidence from the US Banking Sector Article Swipe

Related Concepts

Deposit insurance

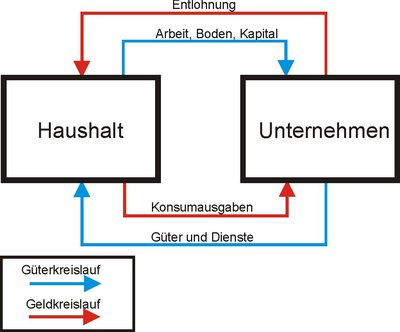

Economics

Financial fragility

Competition (biology)

Fragility

Bank run

Monetary economics

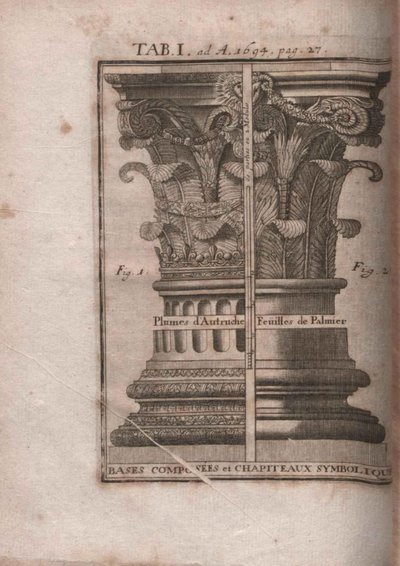

Capital (architecture)

Capital requirement

Financial distress

Empirical evidence

Bank failure

Financial system

Financial crisis

Finance

Macroeconomics

Microeconomics

Market liquidity

History

Biology

Physical chemistry

Incentive

Ecology

Chemistry

Archaeology

Epistemology

Philosophy

Mark Egan

,

Alı Hortaçsu

,

Gregor Matvos

·

YOU?

·

· 2016

· Open Access

·

· DOI: https://doi.org/10.1257/aer.20150342

· OA: W2201756657

YOU?

·

· 2016

· Open Access

·

· DOI: https://doi.org/10.1257/aer.20150342

· OA: W2201756657

YOU?

·

· 2016

· Open Access

·

· DOI: https://doi.org/10.1257/aer.20150342

· OA: W2201756657

YOU?

·

· 2016

· Open Access

·

· DOI: https://doi.org/10.1257/aer.20150342

· OA: W2201756657

We develop a structural empirical model of the US banking sector. Insured depositors and run-prone uninsured depositors choose between differentiated banks. Banks compete for deposits and endogenously default. The estimated demand for uninsured deposits declines with banks' financial distress, which is not the case for insured deposits. We calibrate the supply side of the model. The calibrated model possesses multiple equilibria with bank-run features, suggesting that banks can be very fragile. We use our model to analyze proposed bank regulations. For example, our results suggest that a capital requirement below 18 percent can lead to significant instability in the banking system. (JEL E44, G01, G21, G28, G32)

Related Topics

Finding more related topics…