The real effects of household debt in the short and long run Article Swipe

YOU?

·

· 2017

· Open Access

·

· OA: W2585102722

YOU?

·

· 2017

· Open Access

·

· OA: W2585102722

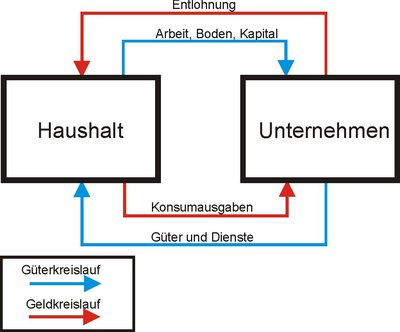

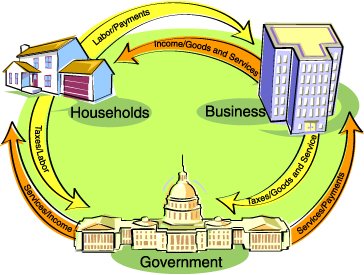

Household debt levels relative to GDP have risen rapidly in many countries over the past decade. We investigate the macroeconomic impact of such increases by employing a novel estimation technique proposed by Chudik et al (2016), which tackles the problem of endogeneity present in traditional regressions. Using data on 54 economies over 1990-2015, we show that household debt boosts consumption and GDP growth in the short run, mostly within one year. By contrast, a 1 percentage point increase in the household debt-to-GDP ratio tends to lower growth in the long run by 0.1 percentage point. Our results suggest that the negative long-run effects on consumption tend to intensify as the household debt-to-GDP ratio exceeds 60%. For GDP growth, that intensification seems to occur when the ratio exceeds 80%. Finally, we find that the degree of legal protection of creditors is able to account for the cross-country variation in the long-run impact.