The deteriorating usefulness of financial report information and how to reverse it Article Swipe

YOU?

·

· 2018

· Open Access

·

· DOI: https://doi.org/10.1080/00014788.2018.1470138

· OA: W2805139665

YOU?

·

· 2018

· Open Access

·

· DOI: https://doi.org/10.1080/00014788.2018.1470138

· OA: W2805139665

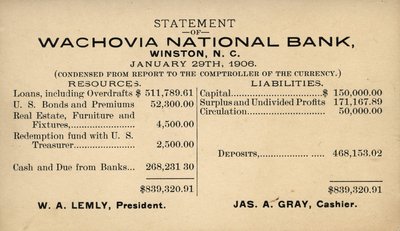

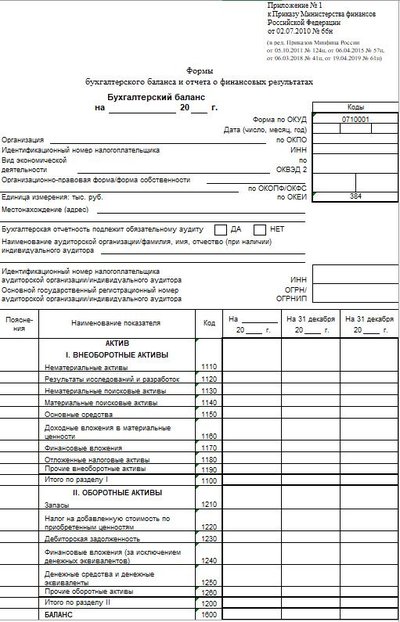

There is a wide-spread and growing dissatisfaction with the relevance and usefulness of financial report information, particularly among investors and corporate executives. The dissatisfaction is corroborated by extensive research which consistently documents a growing gap between capital market indicators and financial information, more so for reported earnings. The reported earnings of most firms no longer reflect enterprise performance. I trace the deterioration of the usefulness of financial information to: (1) the abandonment by accounting standard-setters of the traditional income statement (matching) model in favour of a balance sheet (asset valuation) model, and (2) standard-setters’ failure to adjust asset recognition rules to the fundamental shift in corporate value-creating resources from tangible to intangible assets. I conclude this paper with change proposals to restore the usefulness of financial information to investors.