Adaptive Risk Hedging for Call Options under Cox-Ingersoll-Ross Interest Rates Article Swipe

Related Concepts

Niloofar Ghorbani

,

Andrzej Korzeniowski

·

YOU?

·

· 2020

· Open Access

·

· DOI: https://doi.org/10.4236/jmf.2020.104040

· OA: W3107910116

YOU?

·

· 2020

· Open Access

·

· DOI: https://doi.org/10.4236/jmf.2020.104040

· OA: W3107910116

YOU?

·

· 2020

· Open Access

·

· DOI: https://doi.org/10.4236/jmf.2020.104040

· OA: W3107910116

YOU?

·

· 2020

· Open Access

·

· DOI: https://doi.org/10.4236/jmf.2020.104040

· OA: W3107910116

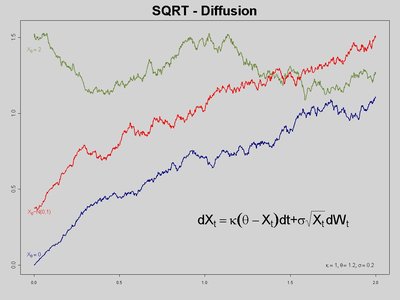

We present a solution to the problem posed by Zhang et al. [1] regarding Call Option price CT under linear investment hedging for the stochastic interest rate modeled by a CIR Process. A closed form representation for CT by expected value of the path-integral along a square functional of n-dimensional Ornstein-Uhlenbeck process is derived. The method is suitable for Monte-Carlo simulation and illustrated by an example.

Related Topics

Finding more related topics…