Gender differences in the contribution patterns of equity-crowdfunding investors Article Swipe

Related Concepts

Ali Mohammadi

,

Kourosh Shafi

·

YOU?

·

· 2017

· Open Access

·

· DOI: https://doi.org/10.1007/s11187-016-9825-7

· OA: W3124067722

YOU?

·

· 2017

· Open Access

·

· DOI: https://doi.org/10.1007/s11187-016-9825-7

· OA: W3124067722

YOU?

·

· 2017

· Open Access

·

· DOI: https://doi.org/10.1007/s11187-016-9825-7

· OA: W3124067722

YOU?

·

· 2017

· Open Access

·

· DOI: https://doi.org/10.1007/s11187-016-9825-7

· OA: W3124067722

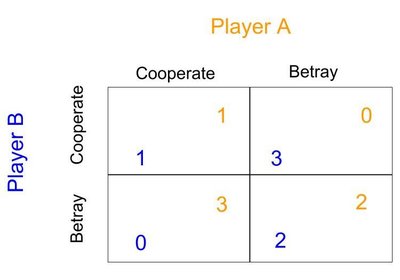

This paper is an exploratory attempt to understand gender-related differences in the behavior of investors in firms seeking equity financing. Using data from the Swedish equity crowdfunding platform FundedByMe, we find that female investors are less likely to invest in the equity of firms that are younger and high tech and have a higher percentage of equity offerings. This pattern seems consistent with a greater risk aversion in female versus male investors. Furthermore, female investors are more likely to invest in projects in which the proportion of male investors is higher.

Related Topics

Finding more related topics…