A Global Macroeconomic Risk Model for Value, Momentum, and Other Asset Classes Article Swipe

Related Concepts

Momentum (technical analysis)

Economics

Asset (computer security)

Capital asset pricing model

Econometrics

Financial economics

Value (mathematics)

Risk premium

Asset allocation

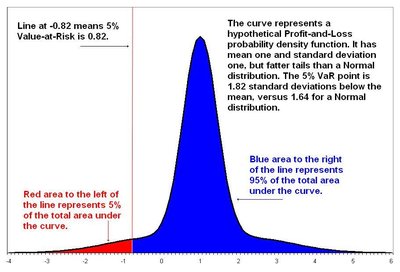

Value at risk

Monetary economics

Finance

Mathematics

Risk management

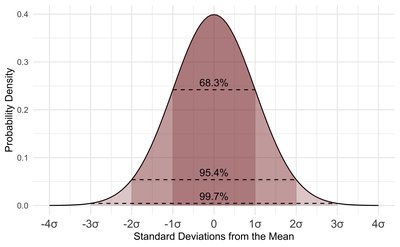

Statistics

Portfolio

Computer science

Computer security

Ilan Cooper

,

Andreea Mitrache

,

Richard Priestley

·

YOU?

·

· 2020

· Open Access

·

· DOI: https://doi.org/10.1017/s0022109020000824

· OA: W3124747293

YOU?

·

· 2020

· Open Access

·

· DOI: https://doi.org/10.1017/s0022109020000824

· OA: W3124747293

YOU?

·

· 2020

· Open Access

·

· DOI: https://doi.org/10.1017/s0022109020000824

· OA: W3124747293

YOU?

·

· 2020

· Open Access

·

· DOI: https://doi.org/10.1017/s0022109020000824

· OA: W3124747293

Value and momentum returns and combinations of them across both countries and asset classes are explained by their loadings on global macroeconomic risk factors. These loadings describe why value and momentum have positive return premia, although being negatively correlated. The global macroeconomic risk factors also perform well in capturing the returns on other characteristic-based portfolios. The findings identify a global macroeconomic source of the common variation in returns across countries and asset classes.

Related Topics

Finding more related topics…