The Limits of Model‐Based Regulation Article Swipe

Related Concepts

Capital requirement

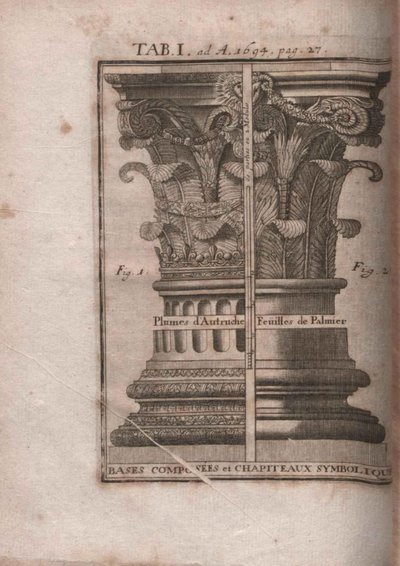

Capital (architecture)

Asset (computer security)

Capital adequacy ratio

Loan

Financial stability

Bank regulation

Monetary economics

Business

Economics

Stability (learning theory)

Actuarial science

Finance

Financial system

Microeconomics

Computer science

Computer security

Profit (economics)

Incentive

Machine learning

History

Archaeology

Markus Behn

,

Rainer Haselmann

,

Vikrant Vig

·

YOU?

·

· 2022

· Open Access

·

· DOI: https://doi.org/10.1111/jofi.13124

· OA: W3124947353

YOU?

·

· 2022

· Open Access

·

· DOI: https://doi.org/10.1111/jofi.13124

· OA: W3124947353

YOU?

·

· 2022

· Open Access

·

· DOI: https://doi.org/10.1111/jofi.13124

· OA: W3124947353

YOU?

·

· 2022

· Open Access

·

· DOI: https://doi.org/10.1111/jofi.13124

· OA: W3124947353

Using loan‐level data from Germany, we investigate how the introduction of model‐based capital regulation affected banks' ability to absorb shocks. The objective of this regulation was to enhance financial stability by making capital requirements responsive to asset risk. Our evidence suggests that banks “optimized” model‐based regulation to lower their capital requirements. Banks systematically underreported risk, with underreporting more pronounced for banks with higher gains from it. Moreover, large banks benefitted from the regulation at the expense of smaller banks. Overall, our results suggest that sophisticated rules may have undesired effects if strategic misbehavior is difficult to detect.

Related Topics

Finding more related topics…