Prospect Theory and Stock Market Anomalies Article Swipe

Related Concepts

Nicholas Barberis

,

Lawrence J. Jin

,

BAOLIAN WANG

·

YOU?

·

· 2021

· Open Access

·

· DOI: https://doi.org/10.1111/jofi.13061

· OA: W4205713541

YOU?

·

· 2021

· Open Access

·

· DOI: https://doi.org/10.1111/jofi.13061

· OA: W4205713541

YOU?

·

· 2021

· Open Access

·

· DOI: https://doi.org/10.1111/jofi.13061

· OA: W4205713541

YOU?

·

· 2021

· Open Access

·

· DOI: https://doi.org/10.1111/jofi.13061

· OA: W4205713541

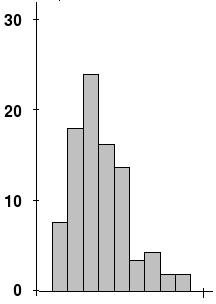

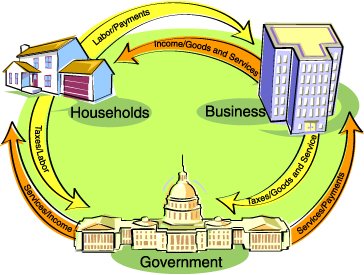

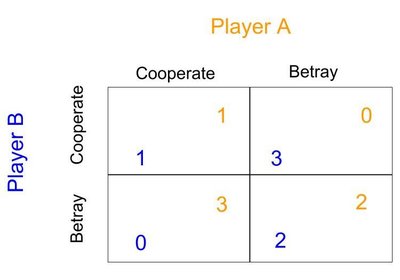

We present a new model of asset prices in which investors evaluate risk according to prospect theory and examine its ability to explain 23 prominent stock market anomalies. The model incorporates all of the elements of prospect theory, accounts for investors' prior gains and losses, and makes quantitative predictions about an asset's average return based on empirical estimates of the asset's return volatility, return skewness, and past capital gain. We find that the model can help explain a majority of the 23 anomalies.

Related Topics

Finding more related topics…