Liquidity and clientele effects in green debt markets Article Swipe

Related Concepts

Market liquidity

Monetary economics

Debt

Economics

Business

Financial system

Finance

Dion Bongaerts

,

Dirk Schoenmaker

·

YOU?

·

· 2024

· Open Access

·

· DOI: https://doi.org/10.1016/j.jcorpfin.2024.102582

· OA: W4394945597

YOU?

·

· 2024

· Open Access

·

· DOI: https://doi.org/10.1016/j.jcorpfin.2024.102582

· OA: W4394945597

YOU?

·

· 2024

· Open Access

·

· DOI: https://doi.org/10.1016/j.jcorpfin.2024.102582

· OA: W4394945597

YOU?

·

· 2024

· Open Access

·

· DOI: https://doi.org/10.1016/j.jcorpfin.2024.102582

· OA: W4394945597

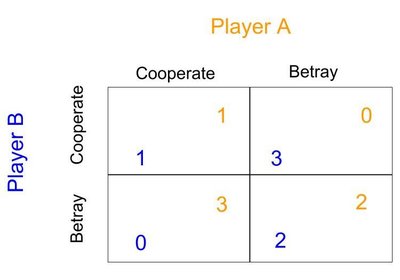

We jointly model green and regular bond markets. Green bonds can improve allocative efficiency and lower financing costs for green projects, but economies of scale, like liquidity fragmentation, may cause friction. Consequently, profitable and welfare-enhancing projects, green and brown, can be rationed in equilibrium. Rationing green projects happens with a shortage of climate investors, large non-monetary offsets, and/or costly fragmentation. Rationing regular projects can happen with a shortage of regular investors, but also with an abundance, when more profitable green projects crowd out regular ones. We propose an alternative security design that preserves green earmarking but prevents fragmentation.

Related Topics

Finding more related topics…