Loss Coverage: Why Insurance Works Better with Some Adverse Selection Article Swipe

Related Concepts

Adverse selection

Underwriting

Actuarial science

Argument (complex analysis)

Group insurance

Exaggeration

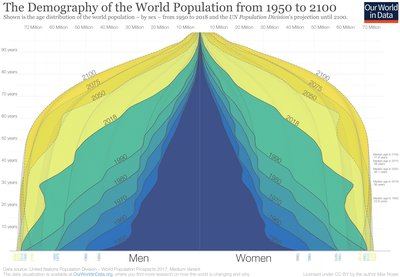

Population

Economics

Selection (genetic algorithm)

Public economics

Insurance policy

General insurance

Income protection insurance

Medicine

Sociology

Computer science

Demography

Internal medicine

Artificial intelligence

Psychiatry

R. Guy Thomas

·

YOU?

·

· 2017

· Open Access

·

· DOI: https://doi.org/10.1017/9781316178843

· OA: W2611941790

YOU?

·

· 2017

· Open Access

·

· DOI: https://doi.org/10.1017/9781316178843

· OA: W2611941790

YOU?

·

· 2017

· Open Access

·

· DOI: https://doi.org/10.1017/9781316178843

· OA: W2611941790

YOU?

·

· 2017

· Open Access

·

· DOI: https://doi.org/10.1017/9781316178843

· OA: W2611941790

Insurers typically argue that regulatory limits on risk classification will induce ‘adverse selection’; they say that this has disadvantages not just for insurers, but also for society as a whole. I argue that even on its own terms, this argument is often flawed. From the viewpoint of society as a whole, not all adverse selection is adverse. Limits on risk classification which induce the right amount of adverse selection (but not too much adverse selection) can increase ‘loss coverage’, and so make insurance work better for society as a whole.

Related Topics

Finding more related topics…