Predicting ETF prices using linear regression Article Swipe

Related Concepts

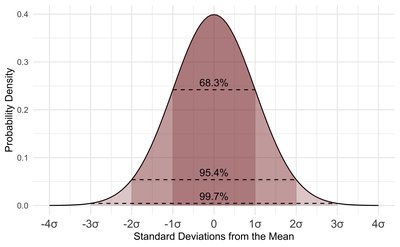

Simple linear regression

Vanguard

Linear regression

Closing (real estate)

Regression

Econometrics

Simple (philosophy)

Data set

Regression analysis

Computer science

Set (abstract data type)

Proper linear model

Polynomial regression

Statistics

Artificial intelligence

Mathematics

Economics

Machine learning

Finance

Geography

Archaeology

Philosophy

Programming language

Epistemology

Keqing Li

·

YOU?

·

· 2023

· Open Access

·

· DOI: https://doi.org/10.54691/bcpbm.v36i.3381

· OA: W4352990935

YOU?

·

· 2023

· Open Access

·

· DOI: https://doi.org/10.54691/bcpbm.v36i.3381

· OA: W4352990935

YOU?

·

· 2023

· Open Access

·

· DOI: https://doi.org/10.54691/bcpbm.v36i.3381

· OA: W4352990935

YOU?

·

· 2023

· Open Access

·

· DOI: https://doi.org/10.54691/bcpbm.v36i.3381

· OA: W4352990935

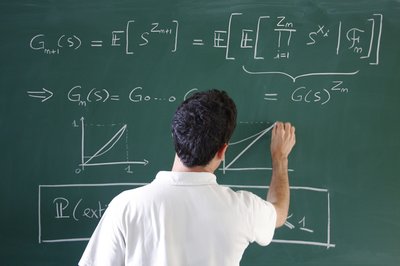

Machine learning has allowed computers to analyze data and make future predictions based on those dates. One of the most common and easiest to implement machine learning algorithms used to do this is simple linear regression. Simple linear regression finds trends in a data set by graphing a line that shows the relationship between two variables. This paper will show how Simple linear regression can predict future ETF prices by finding linear trends in two particular exchange-traded funds: Invesco QQQ and vanguard VGT, predict their value six months later using their five-year closing price in yahoo finance and compare their respective predicted growth rate.

Related Topics

Finding more related topics…