Tractable Term-Structure Models Article Swipe

YOU?

·

· 2021

· Open Access

·

· DOI: https://doi.org/10.34989/swp-2015-46

YOU?

·

· 2021

· Open Access

·

· DOI: https://doi.org/10.34989/swp-2015-46

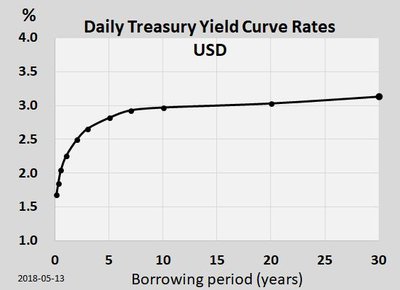

We introduce a new framework that facilitates term structure modeling with both positive interest rates and flexible time-series dynamics but that is also tractable, meaning amenable to quick and robust estimation. Using both simulations and U.S. historical data, we compare our approach with benchmark Gaussian and stochastic volatility models as well as a shadow rate model that enforces positive interest rates. Our approach, which remains arbitrarily close to arbitrage-free, offers a more accurate characterization of bond Sharpe ratios due to a better fit of the volatility dynamics and a more efficient estimation of the return dynamics. Further, standard shadow rate and stochastic volatility models exhibit important restrictions that are largely absent in our approach.

Related Topics

- Type

- preprint

- Language

- en

- Landing Page

- http://hdl.handle.net/10419/141989

- http://hdl.handle.net/10419/141989

- OA Status

- green

- Related Works

- 20

- OpenAlex ID

- https://openalex.org/W3195869293

Raw OpenAlex JSON

- OpenAlex ID

-

https://openalex.org/W3195869293Canonical identifier for this work in OpenAlex

- DOI

-

https://doi.org/10.34989/swp-2015-46Digital Object Identifier

- Title

-

Tractable Term-Structure ModelsWork title

- Type

-

preprintOpenAlex work type

- Language

-

enPrimary language

- Publication year

-

2021Year of publication

- Publication date

-

2021-07-01Full publication date if available

- Authors

-

Anh Le, Bruno Feunou, Christian Lundblad, Jean‐Sébastien FontaineList of authors in order

- Landing page

-

https://hdl.handle.net/10419/141989Publisher landing page

- PDF URL

-

https://hdl.handle.net/10419/141989Direct link to full text PDF

- Open access

-

YesWhether a free full text is available

- OA status

-

greenOpen access status per OpenAlex

- OA URL

-

https://hdl.handle.net/10419/141989Direct OA link when available

- Concepts

-

Econometrics, Stochastic volatility, Volatility (finance), Affine term structure model, Interest rate, Short rate, Term (time), Sharpe ratio, Rendleman–Bartter model, Short-rate model, Bond valuation, Computer science, Yield curve, Gaussian, Heath–Jarrow–Morton framework, Interest rate derivative, Vasicek model, Economics, Financial economics, Finance, Physics, Quantum mechanics, PortfolioTop concepts (fields/topics) attached by OpenAlex

- Cited by

-

0Total citation count in OpenAlex

- Related works (count)

-

20Other works algorithmically related by OpenAlex

Full payload

| id | https://openalex.org/W3195869293 |

|---|---|

| doi | https://doi.org/10.34989/swp-2015-46 |

| ids.doi | https://doi.org/10.34989/swp-2015-46 |

| ids.mag | 3195869293 |

| ids.openalex | https://openalex.org/W3195869293 |

| fwci | 0.0 |

| type | preprint |

| title | Tractable Term-Structure Models |

| biblio.issue | |

| biblio.volume | |

| biblio.last_page | |

| biblio.first_page | |

| topics[0].id | https://openalex.org/T10067 |

| topics[0].field.id | https://openalex.org/fields/20 |

| topics[0].field.display_name | Economics, Econometrics and Finance |

| topics[0].score | 0.9879000186920166 |

| topics[0].domain.id | https://openalex.org/domains/2 |

| topics[0].domain.display_name | Social Sciences |

| topics[0].subfield.id | https://openalex.org/subfields/2003 |

| topics[0].subfield.display_name | Finance |

| topics[0].display_name | Stochastic processes and financial applications |

| topics[1].id | https://openalex.org/T10007 |

| topics[1].field.id | https://openalex.org/fields/20 |

| topics[1].field.display_name | Economics, Econometrics and Finance |

| topics[1].score | 0.9620000123977661 |

| topics[1].domain.id | https://openalex.org/domains/2 |

| topics[1].domain.display_name | Social Sciences |

| topics[1].subfield.id | https://openalex.org/subfields/2000 |

| topics[1].subfield.display_name | General Economics, Econometrics and Finance |

| topics[1].display_name | Monetary Policy and Economic Impact |

| topics[2].id | https://openalex.org/T10282 |

| topics[2].field.id | https://openalex.org/fields/20 |

| topics[2].field.display_name | Economics, Econometrics and Finance |

| topics[2].score | 0.9541000127792358 |

| topics[2].domain.id | https://openalex.org/domains/2 |

| topics[2].domain.display_name | Social Sciences |

| topics[2].subfield.id | https://openalex.org/subfields/2003 |

| topics[2].subfield.display_name | Finance |

| topics[2].display_name | Financial Risk and Volatility Modeling |

| is_xpac | False |

| apc_list | |

| apc_paid | |

| concepts[0].id | https://openalex.org/C149782125 |

| concepts[0].level | 1 |

| concepts[0].score | 0.6779089570045471 |

| concepts[0].wikidata | https://www.wikidata.org/wiki/Q160039 |

| concepts[0].display_name | Econometrics |

| concepts[1].id | https://openalex.org/C85393063 |

| concepts[1].level | 3 |

| concepts[1].score | 0.6228830218315125 |

| concepts[1].wikidata | https://www.wikidata.org/wiki/Q596307 |

| concepts[1].display_name | Stochastic volatility |

| concepts[2].id | https://openalex.org/C91602232 |

| concepts[2].level | 2 |

| concepts[2].score | 0.5896226763725281 |

| concepts[2].wikidata | https://www.wikidata.org/wiki/Q756115 |

| concepts[2].display_name | Volatility (finance) |

| concepts[3].id | https://openalex.org/C40753778 |

| concepts[3].level | 4 |

| concepts[3].score | 0.5594087243080139 |

| concepts[3].wikidata | https://www.wikidata.org/wiki/Q4688953 |

| concepts[3].display_name | Affine term structure model |

| concepts[4].id | https://openalex.org/C175025494 |

| concepts[4].level | 2 |

| concepts[4].score | 0.5465219020843506 |

| concepts[4].wikidata | https://www.wikidata.org/wiki/Q179179 |

| concepts[4].display_name | Interest rate |

| concepts[5].id | https://openalex.org/C54775282 |

| concepts[5].level | 4 |

| concepts[5].score | 0.5271439552307129 |

| concepts[5].wikidata | https://www.wikidata.org/wiki/Q7502071 |

| concepts[5].display_name | Short rate |

| concepts[6].id | https://openalex.org/C61797465 |

| concepts[6].level | 2 |

| concepts[6].score | 0.5000288486480713 |

| concepts[6].wikidata | https://www.wikidata.org/wiki/Q1188986 |

| concepts[6].display_name | Term (time) |

| concepts[7].id | https://openalex.org/C139938925 |

| concepts[7].level | 3 |

| concepts[7].score | 0.49980759620666504 |

| concepts[7].wikidata | https://www.wikidata.org/wiki/Q1501898 |

| concepts[7].display_name | Sharpe ratio |

| concepts[8].id | https://openalex.org/C108018779 |

| concepts[8].level | 3 |

| concepts[8].score | 0.4917629063129425 |

| concepts[8].wikidata | https://www.wikidata.org/wiki/Q7312852 |

| concepts[8].display_name | Rendleman–Bartter model |

| concepts[9].id | https://openalex.org/C93246554 |

| concepts[9].level | 3 |

| concepts[9].score | 0.48447442054748535 |

| concepts[9].wikidata | https://www.wikidata.org/wiki/Q4162534 |

| concepts[9].display_name | Short-rate model |

| concepts[10].id | https://openalex.org/C32959826 |

| concepts[10].level | 3 |

| concepts[10].score | 0.46721023321151733 |

| concepts[10].wikidata | https://www.wikidata.org/wiki/Q2361268 |

| concepts[10].display_name | Bond valuation |

| concepts[11].id | https://openalex.org/C41008148 |

| concepts[11].level | 0 |

| concepts[11].score | 0.45298346877098083 |

| concepts[11].wikidata | https://www.wikidata.org/wiki/Q21198 |

| concepts[11].display_name | Computer science |

| concepts[12].id | https://openalex.org/C176230804 |

| concepts[12].level | 3 |

| concepts[12].score | 0.4518555700778961 |

| concepts[12].wikidata | https://www.wikidata.org/wiki/Q205257 |

| concepts[12].display_name | Yield curve |

| concepts[13].id | https://openalex.org/C163716315 |

| concepts[13].level | 2 |

| concepts[13].score | 0.4496956467628479 |

| concepts[13].wikidata | https://www.wikidata.org/wiki/Q901177 |

| concepts[13].display_name | Gaussian |

| concepts[14].id | https://openalex.org/C187614132 |

| concepts[14].level | 3 |

| concepts[14].score | 0.44934898614883423 |

| concepts[14].wikidata | https://www.wikidata.org/wiki/Q1563747 |

| concepts[14].display_name | Heath–Jarrow–Morton framework |

| concepts[15].id | https://openalex.org/C128029710 |

| concepts[15].level | 3 |

| concepts[15].score | 0.43842849135398865 |

| concepts[15].wikidata | https://www.wikidata.org/wiki/Q205180 |

| concepts[15].display_name | Interest rate derivative |

| concepts[16].id | https://openalex.org/C201608381 |

| concepts[16].level | 3 |

| concepts[16].score | 0.41953369975090027 |

| concepts[16].wikidata | https://www.wikidata.org/wiki/Q2331759 |

| concepts[16].display_name | Vasicek model |

| concepts[17].id | https://openalex.org/C162324750 |

| concepts[17].level | 0 |

| concepts[17].score | 0.4066675305366516 |

| concepts[17].wikidata | https://www.wikidata.org/wiki/Q8134 |

| concepts[17].display_name | Economics |

| concepts[18].id | https://openalex.org/C106159729 |

| concepts[18].level | 1 |

| concepts[18].score | 0.18471232056617737 |

| concepts[18].wikidata | https://www.wikidata.org/wiki/Q2294553 |

| concepts[18].display_name | Financial economics |

| concepts[19].id | https://openalex.org/C10138342 |

| concepts[19].level | 1 |

| concepts[19].score | 0.11234545707702637 |

| concepts[19].wikidata | https://www.wikidata.org/wiki/Q43015 |

| concepts[19].display_name | Finance |

| concepts[20].id | https://openalex.org/C121332964 |

| concepts[20].level | 0 |

| concepts[20].score | 0.0 |

| concepts[20].wikidata | https://www.wikidata.org/wiki/Q413 |

| concepts[20].display_name | Physics |

| concepts[21].id | https://openalex.org/C62520636 |

| concepts[21].level | 1 |

| concepts[21].score | 0.0 |

| concepts[21].wikidata | https://www.wikidata.org/wiki/Q944 |

| concepts[21].display_name | Quantum mechanics |

| concepts[22].id | https://openalex.org/C2780821815 |

| concepts[22].level | 2 |

| concepts[22].score | 0.0 |

| concepts[22].wikidata | https://www.wikidata.org/wiki/Q5340806 |

| concepts[22].display_name | Portfolio |

| keywords[0].id | https://openalex.org/keywords/econometrics |

| keywords[0].score | 0.6779089570045471 |

| keywords[0].display_name | Econometrics |

| keywords[1].id | https://openalex.org/keywords/stochastic-volatility |

| keywords[1].score | 0.6228830218315125 |

| keywords[1].display_name | Stochastic volatility |

| keywords[2].id | https://openalex.org/keywords/volatility |

| keywords[2].score | 0.5896226763725281 |

| keywords[2].display_name | Volatility (finance) |

| keywords[3].id | https://openalex.org/keywords/affine-term-structure-model |

| keywords[3].score | 0.5594087243080139 |

| keywords[3].display_name | Affine term structure model |

| keywords[4].id | https://openalex.org/keywords/interest-rate |

| keywords[4].score | 0.5465219020843506 |

| keywords[4].display_name | Interest rate |

| keywords[5].id | https://openalex.org/keywords/short-rate |

| keywords[5].score | 0.5271439552307129 |

| keywords[5].display_name | Short rate |

| keywords[6].id | https://openalex.org/keywords/term |

| keywords[6].score | 0.5000288486480713 |

| keywords[6].display_name | Term (time) |

| keywords[7].id | https://openalex.org/keywords/sharpe-ratio |

| keywords[7].score | 0.49980759620666504 |

| keywords[7].display_name | Sharpe ratio |

| keywords[8].id | https://openalex.org/keywords/rendleman–bartter-model |

| keywords[8].score | 0.4917629063129425 |

| keywords[8].display_name | Rendleman–Bartter model |

| keywords[9].id | https://openalex.org/keywords/short-rate-model |

| keywords[9].score | 0.48447442054748535 |

| keywords[9].display_name | Short-rate model |

| keywords[10].id | https://openalex.org/keywords/bond-valuation |

| keywords[10].score | 0.46721023321151733 |

| keywords[10].display_name | Bond valuation |

| keywords[11].id | https://openalex.org/keywords/computer-science |

| keywords[11].score | 0.45298346877098083 |

| keywords[11].display_name | Computer science |

| keywords[12].id | https://openalex.org/keywords/yield-curve |

| keywords[12].score | 0.4518555700778961 |

| keywords[12].display_name | Yield curve |

| keywords[13].id | https://openalex.org/keywords/gaussian |

| keywords[13].score | 0.4496956467628479 |

| keywords[13].display_name | Gaussian |

| keywords[14].id | https://openalex.org/keywords/heath–jarrow–morton-framework |

| keywords[14].score | 0.44934898614883423 |

| keywords[14].display_name | Heath–Jarrow–Morton framework |

| keywords[15].id | https://openalex.org/keywords/interest-rate-derivative |

| keywords[15].score | 0.43842849135398865 |

| keywords[15].display_name | Interest rate derivative |

| keywords[16].id | https://openalex.org/keywords/vasicek-model |

| keywords[16].score | 0.41953369975090027 |

| keywords[16].display_name | Vasicek model |

| keywords[17].id | https://openalex.org/keywords/economics |

| keywords[17].score | 0.4066675305366516 |

| keywords[17].display_name | Economics |

| keywords[18].id | https://openalex.org/keywords/financial-economics |

| keywords[18].score | 0.18471232056617737 |

| keywords[18].display_name | Financial economics |

| keywords[19].id | https://openalex.org/keywords/finance |

| keywords[19].score | 0.11234545707702637 |

| keywords[19].display_name | Finance |

| language | en |

| locations[0].id | pmh:oai:econstor.eu:10419/141989 |

| locations[0].is_oa | True |

| locations[0].source.id | https://openalex.org/S4306401696 |

| locations[0].source.issn | |

| locations[0].source.type | repository |

| locations[0].source.is_oa | False |

| locations[0].source.issn_l | |

| locations[0].source.is_core | False |

| locations[0].source.is_in_doaj | False |

| locations[0].source.display_name | Econstor (Econstor) |

| locations[0].source.host_organization | |

| locations[0].source.host_organization_name | |

| locations[0].license | |

| locations[0].pdf_url | http://hdl.handle.net/10419/141989 |

| locations[0].version | submittedVersion |

| locations[0].raw_type | doc-type:workingPaper |

| locations[0].license_id | |

| locations[0].is_accepted | False |

| locations[0].is_published | False |

| locations[0].raw_source_name | |

| locations[0].landing_page_url | http://hdl.handle.net/10419/141989 |

| locations[1].id | mag:3195869293 |

| locations[1].is_oa | False |

| locations[1].source.id | https://openalex.org/S4306401271 |

| locations[1].source.issn | |

| locations[1].source.type | repository |

| locations[1].source.is_oa | False |

| locations[1].source.issn_l | |

| locations[1].source.is_core | False |

| locations[1].source.is_in_doaj | False |

| locations[1].source.display_name | RePEc: Research Papers in Economics |

| locations[1].source.host_organization | https://openalex.org/I77793887 |

| locations[1].source.host_organization_name | Federal Reserve Bank of St. Louis |

| locations[1].source.host_organization_lineage | https://openalex.org/I77793887 |

| locations[1].license | |

| locations[1].pdf_url | |

| locations[1].version | submittedVersion |

| locations[1].raw_type | |

| locations[1].license_id | |

| locations[1].is_accepted | False |

| locations[1].is_published | False |

| locations[1].raw_source_name | RePEc: Research Papers in Economics |

| locations[1].landing_page_url | https://ideas.repec.org/p/bca/bocawp/15-46.html |

| locations[2].id | doi:10.34989/swp-2015-46 |

| locations[2].is_oa | True |

| locations[2].source.id | https://openalex.org/S7407050688 |

| locations[2].source.type | repository |

| locations[2].source.is_oa | False |

| locations[2].source.issn_l | |

| locations[2].source.is_core | False |

| locations[2].source.is_in_doaj | False |

| locations[2].source.display_name | Bank of Canada Research |

| locations[2].source.host_organization | |

| locations[2].source.host_organization_name | |

| locations[2].license | |

| locations[2].pdf_url | |

| locations[2].version | |

| locations[2].raw_type | article-journal |

| locations[2].license_id | |

| locations[2].is_accepted | False |

| locations[2].is_published | |

| locations[2].raw_source_name | |

| locations[2].landing_page_url | https://doi.org/10.34989/swp-2015-46 |

| indexed_in | datacite |

| authorships[0].author.id | https://openalex.org/A5041667430 |

| authorships[0].author.orcid | https://orcid.org/0000-0002-0821-4009 |

| authorships[0].author.display_name | Anh Le |

| authorships[0].author_position | first |

| authorships[0].raw_author_name | Anh Le |

| authorships[0].is_corresponding | False |

| authorships[1].author.id | https://openalex.org/A5052989192 |

| authorships[1].author.orcid | https://orcid.org/0000-0001-8023-0161 |

| authorships[1].author.display_name | Bruno Feunou |

| authorships[1].author_position | middle |

| authorships[1].raw_author_name | Bruno Feunou |

| authorships[1].is_corresponding | False |

| authorships[2].author.id | https://openalex.org/A5063542668 |

| authorships[2].author.orcid | https://orcid.org/0000-0003-1937-5462 |

| authorships[2].author.display_name | Christian Lundblad |

| authorships[2].author_position | middle |

| authorships[2].raw_author_name | Christian Lundblad |

| authorships[2].is_corresponding | False |

| authorships[3].author.id | https://openalex.org/A5017324252 |

| authorships[3].author.orcid | https://orcid.org/0000-0001-9346-4645 |

| authorships[3].author.display_name | Jean‐Sébastien Fontaine |

| authorships[3].author_position | last |

| authorships[3].raw_author_name | Jean-Sébastien Fontaine |

| authorships[3].is_corresponding | False |

| has_content.pdf | True |

| has_content.grobid_xml | True |

| is_paratext | False |

| open_access.is_oa | True |

| open_access.oa_url | http://hdl.handle.net/10419/141989 |

| open_access.oa_status | green |

| open_access.any_repository_has_fulltext | False |

| created_date | 2021-08-30T00:00:00 |

| display_name | Tractable Term-Structure Models |

| has_fulltext | False |

| is_retracted | False |

| updated_date | 2025-12-11T00:21:10.989143 |

| primary_topic.id | https://openalex.org/T10067 |

| primary_topic.field.id | https://openalex.org/fields/20 |

| primary_topic.field.display_name | Economics, Econometrics and Finance |

| primary_topic.score | 0.9879000186920166 |

| primary_topic.domain.id | https://openalex.org/domains/2 |

| primary_topic.domain.display_name | Social Sciences |

| primary_topic.subfield.id | https://openalex.org/subfields/2003 |

| primary_topic.subfield.display_name | Finance |

| primary_topic.display_name | Stochastic processes and financial applications |

| related_works | https://openalex.org/W3163535650, https://openalex.org/W2186996075, https://openalex.org/W1488018008, https://openalex.org/W3184250065, https://openalex.org/W1525935934, https://openalex.org/W2761953470, https://openalex.org/W1555352969, https://openalex.org/W3212848174, https://openalex.org/W2192113494, https://openalex.org/W2094624094, https://openalex.org/W2132431225, https://openalex.org/W3140604391, https://openalex.org/W2183258044, https://openalex.org/W3087107280, https://openalex.org/W119172096, https://openalex.org/W2949967793, https://openalex.org/W1597450758, https://openalex.org/W2055535170, https://openalex.org/W2772719965, https://openalex.org/W2245199605 |

| cited_by_count | 0 |

| locations_count | 3 |

| best_oa_location.id | pmh:oai:econstor.eu:10419/141989 |

| best_oa_location.is_oa | True |

| best_oa_location.source.id | https://openalex.org/S4306401696 |

| best_oa_location.source.issn | |

| best_oa_location.source.type | repository |

| best_oa_location.source.is_oa | False |

| best_oa_location.source.issn_l | |

| best_oa_location.source.is_core | False |

| best_oa_location.source.is_in_doaj | False |

| best_oa_location.source.display_name | Econstor (Econstor) |

| best_oa_location.source.host_organization | |

| best_oa_location.source.host_organization_name | |

| best_oa_location.license | |

| best_oa_location.pdf_url | http://hdl.handle.net/10419/141989 |

| best_oa_location.version | submittedVersion |

| best_oa_location.raw_type | doc-type:workingPaper |

| best_oa_location.license_id | |

| best_oa_location.is_accepted | False |

| best_oa_location.is_published | False |

| best_oa_location.raw_source_name | |

| best_oa_location.landing_page_url | http://hdl.handle.net/10419/141989 |

| primary_location.id | pmh:oai:econstor.eu:10419/141989 |

| primary_location.is_oa | True |

| primary_location.source.id | https://openalex.org/S4306401696 |

| primary_location.source.issn | |

| primary_location.source.type | repository |

| primary_location.source.is_oa | False |

| primary_location.source.issn_l | |

| primary_location.source.is_core | False |

| primary_location.source.is_in_doaj | False |

| primary_location.source.display_name | Econstor (Econstor) |

| primary_location.source.host_organization | |

| primary_location.source.host_organization_name | |

| primary_location.license | |

| primary_location.pdf_url | http://hdl.handle.net/10419/141989 |

| primary_location.version | submittedVersion |

| primary_location.raw_type | doc-type:workingPaper |

| primary_location.license_id | |

| primary_location.is_accepted | False |

| primary_location.is_published | False |

| primary_location.raw_source_name | |

| primary_location.landing_page_url | http://hdl.handle.net/10419/141989 |

| publication_date | 2021-07-01 |

| publication_year | 2021 |

| referenced_works_count | 0 |

| abstract_inverted_index.a | 2, 52, 70, 80, 88 |

| abstract_inverted_index.We | 0 |

| abstract_inverted_index.as | 49, 51 |

| abstract_inverted_index.in | 111 |

| abstract_inverted_index.is | 21 |

| abstract_inverted_index.of | 74, 83, 92 |

| abstract_inverted_index.to | 26, 67, 79 |

| abstract_inverted_index.we | 38 |

| abstract_inverted_index.Our | 61 |

| abstract_inverted_index.and | 15, 28, 34, 45, 87, 100 |

| abstract_inverted_index.are | 108 |

| abstract_inverted_index.but | 19 |

| abstract_inverted_index.due | 78 |

| abstract_inverted_index.fit | 82 |

| abstract_inverted_index.new | 3 |

| abstract_inverted_index.our | 40, 112 |

| abstract_inverted_index.the | 84, 93 |

| abstract_inverted_index.U.S. | 35 |

| abstract_inverted_index.also | 22 |

| abstract_inverted_index.bond | 75 |

| abstract_inverted_index.both | 11, 32 |

| abstract_inverted_index.more | 71, 89 |

| abstract_inverted_index.rate | 54, 99 |

| abstract_inverted_index.term | 7 |

| abstract_inverted_index.that | 5, 20, 56, 107 |

| abstract_inverted_index.well | 50 |

| abstract_inverted_index.with | 10, 42 |

| abstract_inverted_index.Using | 31 |

| abstract_inverted_index.close | 66 |

| abstract_inverted_index.data, | 37 |

| abstract_inverted_index.model | 55 |

| abstract_inverted_index.quick | 27 |

| abstract_inverted_index.rates | 14 |

| abstract_inverted_index.which | 63 |

| abstract_inverted_index.Sharpe | 76 |

| abstract_inverted_index.absent | 110 |

| abstract_inverted_index.better | 81 |

| abstract_inverted_index.models | 48, 103 |

| abstract_inverted_index.offers | 69 |

| abstract_inverted_index.rates. | 60 |

| abstract_inverted_index.ratios | 77 |

| abstract_inverted_index.return | 94 |

| abstract_inverted_index.robust | 29 |

| abstract_inverted_index.shadow | 53, 98 |

| abstract_inverted_index.compare | 39 |

| abstract_inverted_index.exhibit | 104 |

| abstract_inverted_index.largely | 109 |

| abstract_inverted_index.meaning | 24 |

| abstract_inverted_index.remains | 64 |

| abstract_inverted_index.Further, | 96 |

| abstract_inverted_index.Gaussian | 44 |

| abstract_inverted_index.accurate | 72 |

| abstract_inverted_index.amenable | 25 |

| abstract_inverted_index.approach | 41 |

| abstract_inverted_index.dynamics | 18, 86 |

| abstract_inverted_index.enforces | 57 |

| abstract_inverted_index.flexible | 16 |

| abstract_inverted_index.interest | 13, 59 |

| abstract_inverted_index.modeling | 9 |

| abstract_inverted_index.positive | 12, 58 |

| abstract_inverted_index.standard | 97 |

| abstract_inverted_index.approach, | 62 |

| abstract_inverted_index.approach. | 113 |

| abstract_inverted_index.benchmark | 43 |

| abstract_inverted_index.dynamics. | 95 |

| abstract_inverted_index.efficient | 90 |

| abstract_inverted_index.framework | 4 |

| abstract_inverted_index.important | 105 |

| abstract_inverted_index.introduce | 1 |

| abstract_inverted_index.structure | 8 |

| abstract_inverted_index.estimation | 91 |

| abstract_inverted_index.historical | 36 |

| abstract_inverted_index.stochastic | 46, 101 |

| abstract_inverted_index.tractable, | 23 |

| abstract_inverted_index.volatility | 47, 85, 102 |

| abstract_inverted_index.arbitrarily | 65 |

| abstract_inverted_index.estimation. | 30 |

| abstract_inverted_index.facilitates | 6 |

| abstract_inverted_index.simulations | 33 |

| abstract_inverted_index.time-series | 17 |

| abstract_inverted_index.restrictions | 106 |

| abstract_inverted_index.arbitrage-free, | 68 |

| abstract_inverted_index.characterization | 73 |

| cited_by_percentile_year | |

| countries_distinct_count | 0 |

| institutions_distinct_count | 4 |

| citation_normalized_percentile.value | 0.19417814 |

| citation_normalized_percentile.is_in_top_1_percent | False |

| citation_normalized_percentile.is_in_top_10_percent | False |