Using Entropy to Forecast Bitcoin’s Daily Conditional Value at Risk Article Swipe

YOU?

·

· 2019

· Open Access

·

· DOI: https://doi.org/10.3390/proceedings2019033007

YOU?

·

· 2019

· Open Access

·

· DOI: https://doi.org/10.3390/proceedings2019033007

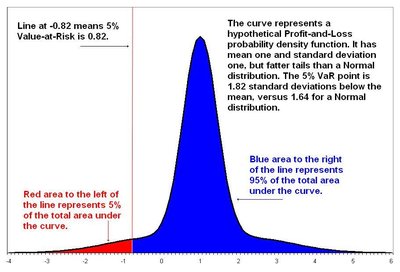

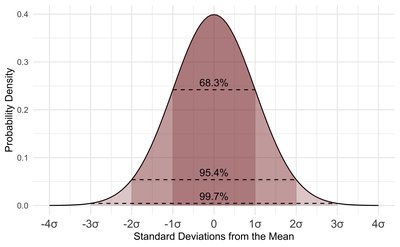

Conditional value at risk (CVaR), or expected shortfall, is a risk measure for investments according to Rockafellar and Uryasev. Yamai and Yoshiba define CVaR as the conditional expectation of loss given that the loss is beyond the value at risk (VaR) level. The VaR is a risk measure that represents how much an investment might lose during usual market conditions with a given probability in a time interval. In particular, Rockafellar and Uryasev show that CVaR is superior to VaR in applications related to investment portfolio optimization. On the other hand, the Shannon entropy has been used as an uncertainty measure in investments and, in particular, to forecast the Bitcoin’s daily VaR. In this paper, we estimate the entropy of intraday distribution of Bitcoin’s logreturns through the symbolic time series analysis (STSA) and we forecast Bitcoin’s daily CVaR using the estimated entropy. We find that the entropy is positively correlated to the likelihood of extreme values of Bitcoin’s daily logreturns using a logistic regression model based on CVaR and the use of entropy to forecast the Bitcoin’s daily CVaR of the next day performs better than the naive use of the historical CVaR.

Related Topics

- Type

- article

- Language

- en

- Landing Page

- https://doi.org/10.3390/proceedings2019033007

- https://www.mdpi.com/2504-3900/33/1/7/pdf?version=1574324322

- OA Status

- gold

- Cited By

- 4

- References

- 20

- Related Works

- 10

- OpenAlex ID

- https://openalex.org/W2989754218

Raw OpenAlex JSON

- OpenAlex ID

-

https://openalex.org/W2989754218Canonical identifier for this work in OpenAlex

- DOI

-

https://doi.org/10.3390/proceedings2019033007Digital Object Identifier

- Title

-

Using Entropy to Forecast Bitcoin’s Daily Conditional Value at RiskWork title

- Type

-

articleOpenAlex work type

- Language

-

enPrimary language

- Publication year

-

2019Year of publication

- Publication date

-

2019-11-21Full publication date if available

- Authors

-

Hellinton H. Takada, Sylvio X. Azevedo, Julio Michael Stern, Celma de Oliveira RibeiroList of authors in order

- Landing page

-

https://doi.org/10.3390/proceedings2019033007Publisher landing page

- PDF URL

-

https://www.mdpi.com/2504-3900/33/1/7/pdf?version=1574324322Direct link to full text PDF

- Open access

-

YesWhether a free full text is available

- OA status

-

goldOpen access status per OpenAlex

- OA URL

-

https://www.mdpi.com/2504-3900/33/1/7/pdf?version=1574324322Direct OA link when available

- Concepts

-

CVAR, Expected shortfall, Econometrics, Coherent risk measure, Entropy (arrow of time), Value at risk, Risk measure, Portfolio, Logistic regression, Economics, Mathematics, Statistics, Financial economics, Risk management, Finance, Physics, Quantum mechanicsTop concepts (fields/topics) attached by OpenAlex

- Cited by

-

4Total citation count in OpenAlex

- Citations by year (recent)

-

2022: 2, 2021: 1, 2020: 1Per-year citation counts (last 5 years)

- References (count)

-

20Number of works referenced by this work

- Related works (count)

-

10Other works algorithmically related by OpenAlex

Full payload

| id | https://openalex.org/W2989754218 |

|---|---|

| doi | https://doi.org/10.3390/proceedings2019033007 |

| ids.doi | https://doi.org/10.3390/proceedings2019033007 |

| ids.mag | 2989754218 |

| ids.openalex | https://openalex.org/W2989754218 |

| fwci | 2.01586831 |

| type | article |

| title | Using Entropy to Forecast Bitcoin’s Daily Conditional Value at Risk |

| biblio.issue | |

| biblio.volume | |

| biblio.last_page | 7 |

| biblio.first_page | 7 |

| topics[0].id | https://openalex.org/T11059 |

| topics[0].field.id | https://openalex.org/fields/20 |

| topics[0].field.display_name | Economics, Econometrics and Finance |

| topics[0].score | 0.9987000226974487 |

| topics[0].domain.id | https://openalex.org/domains/2 |

| topics[0].domain.display_name | Social Sciences |

| topics[0].subfield.id | https://openalex.org/subfields/2002 |

| topics[0].subfield.display_name | Economics and Econometrics |

| topics[0].display_name | Market Dynamics and Volatility |

| topics[1].id | https://openalex.org/T11270 |

| topics[1].field.id | https://openalex.org/fields/20 |

| topics[1].field.display_name | Economics, Econometrics and Finance |

| topics[1].score | 0.9955000281333923 |

| topics[1].domain.id | https://openalex.org/domains/2 |

| topics[1].domain.display_name | Social Sciences |

| topics[1].subfield.id | https://openalex.org/subfields/2002 |

| topics[1].subfield.display_name | Economics and Econometrics |

| topics[1].display_name | Complex Systems and Time Series Analysis |

| topics[2].id | https://openalex.org/T11326 |

| topics[2].field.id | https://openalex.org/fields/18 |

| topics[2].field.display_name | Decision Sciences |

| topics[2].score | 0.9868999719619751 |

| topics[2].domain.id | https://openalex.org/domains/2 |

| topics[2].domain.display_name | Social Sciences |

| topics[2].subfield.id | https://openalex.org/subfields/1803 |

| topics[2].subfield.display_name | Management Science and Operations Research |

| topics[2].display_name | Stock Market Forecasting Methods |

| is_xpac | False |

| apc_list | |

| apc_paid | |

| concepts[0].id | https://openalex.org/C2779922397 |

| concepts[0].level | 4 |

| concepts[0].score | 0.994874119758606 |

| concepts[0].wikidata | https://www.wikidata.org/wiki/Q5014755 |

| concepts[0].display_name | CVAR |

| concepts[1].id | https://openalex.org/C5496284 |

| concepts[1].level | 3 |

| concepts[1].score | 0.8165439367294312 |

| concepts[1].wikidata | https://www.wikidata.org/wiki/Q5420856 |

| concepts[1].display_name | Expected shortfall |

| concepts[2].id | https://openalex.org/C149782125 |

| concepts[2].level | 1 |

| concepts[2].score | 0.6420104503631592 |

| concepts[2].wikidata | https://www.wikidata.org/wiki/Q160039 |

| concepts[2].display_name | Econometrics |

| concepts[3].id | https://openalex.org/C148845407 |

| concepts[3].level | 4 |

| concepts[3].score | 0.5796223282814026 |

| concepts[3].wikidata | https://www.wikidata.org/wiki/Q5141358 |

| concepts[3].display_name | Coherent risk measure |

| concepts[4].id | https://openalex.org/C106301342 |

| concepts[4].level | 2 |

| concepts[4].score | 0.512679934501648 |

| concepts[4].wikidata | https://www.wikidata.org/wiki/Q4117933 |

| concepts[4].display_name | Entropy (arrow of time) |

| concepts[5].id | https://openalex.org/C94128290 |

| concepts[5].level | 3 |

| concepts[5].score | 0.4725118577480316 |

| concepts[5].wikidata | https://www.wikidata.org/wiki/Q963287 |

| concepts[5].display_name | Value at risk |

| concepts[6].id | https://openalex.org/C2781472820 |

| concepts[6].level | 3 |

| concepts[6].score | 0.47069644927978516 |

| concepts[6].wikidata | https://www.wikidata.org/wiki/Q2154759 |

| concepts[6].display_name | Risk measure |

| concepts[7].id | https://openalex.org/C2780821815 |

| concepts[7].level | 2 |

| concepts[7].score | 0.46997517347335815 |

| concepts[7].wikidata | https://www.wikidata.org/wiki/Q5340806 |

| concepts[7].display_name | Portfolio |

| concepts[8].id | https://openalex.org/C151956035 |

| concepts[8].level | 2 |

| concepts[8].score | 0.4274674355983734 |

| concepts[8].wikidata | https://www.wikidata.org/wiki/Q1132755 |

| concepts[8].display_name | Logistic regression |

| concepts[9].id | https://openalex.org/C162324750 |

| concepts[9].level | 0 |

| concepts[9].score | 0.36992016434669495 |

| concepts[9].wikidata | https://www.wikidata.org/wiki/Q8134 |

| concepts[9].display_name | Economics |

| concepts[10].id | https://openalex.org/C33923547 |

| concepts[10].level | 0 |

| concepts[10].score | 0.36005228757858276 |

| concepts[10].wikidata | https://www.wikidata.org/wiki/Q395 |

| concepts[10].display_name | Mathematics |

| concepts[11].id | https://openalex.org/C105795698 |

| concepts[11].level | 1 |

| concepts[11].score | 0.2739589214324951 |

| concepts[11].wikidata | https://www.wikidata.org/wiki/Q12483 |

| concepts[11].display_name | Statistics |

| concepts[12].id | https://openalex.org/C106159729 |

| concepts[12].level | 1 |

| concepts[12].score | 0.2529639005661011 |

| concepts[12].wikidata | https://www.wikidata.org/wiki/Q2294553 |

| concepts[12].display_name | Financial economics |

| concepts[13].id | https://openalex.org/C32896092 |

| concepts[13].level | 2 |

| concepts[13].score | 0.15088671445846558 |

| concepts[13].wikidata | https://www.wikidata.org/wiki/Q189447 |

| concepts[13].display_name | Risk management |

| concepts[14].id | https://openalex.org/C10138342 |

| concepts[14].level | 1 |

| concepts[14].score | 0.11811953783035278 |

| concepts[14].wikidata | https://www.wikidata.org/wiki/Q43015 |

| concepts[14].display_name | Finance |

| concepts[15].id | https://openalex.org/C121332964 |

| concepts[15].level | 0 |

| concepts[15].score | 0.0 |

| concepts[15].wikidata | https://www.wikidata.org/wiki/Q413 |

| concepts[15].display_name | Physics |

| concepts[16].id | https://openalex.org/C62520636 |

| concepts[16].level | 1 |

| concepts[16].score | 0.0 |

| concepts[16].wikidata | https://www.wikidata.org/wiki/Q944 |

| concepts[16].display_name | Quantum mechanics |

| keywords[0].id | https://openalex.org/keywords/cvar |

| keywords[0].score | 0.994874119758606 |

| keywords[0].display_name | CVAR |

| keywords[1].id | https://openalex.org/keywords/expected-shortfall |

| keywords[1].score | 0.8165439367294312 |

| keywords[1].display_name | Expected shortfall |

| keywords[2].id | https://openalex.org/keywords/econometrics |

| keywords[2].score | 0.6420104503631592 |

| keywords[2].display_name | Econometrics |

| keywords[3].id | https://openalex.org/keywords/coherent-risk-measure |

| keywords[3].score | 0.5796223282814026 |

| keywords[3].display_name | Coherent risk measure |

| keywords[4].id | https://openalex.org/keywords/entropy |

| keywords[4].score | 0.512679934501648 |

| keywords[4].display_name | Entropy (arrow of time) |

| keywords[5].id | https://openalex.org/keywords/value-at-risk |

| keywords[5].score | 0.4725118577480316 |

| keywords[5].display_name | Value at risk |

| keywords[6].id | https://openalex.org/keywords/risk-measure |

| keywords[6].score | 0.47069644927978516 |

| keywords[6].display_name | Risk measure |

| keywords[7].id | https://openalex.org/keywords/portfolio |

| keywords[7].score | 0.46997517347335815 |

| keywords[7].display_name | Portfolio |

| keywords[8].id | https://openalex.org/keywords/logistic-regression |

| keywords[8].score | 0.4274674355983734 |

| keywords[8].display_name | Logistic regression |

| keywords[9].id | https://openalex.org/keywords/economics |

| keywords[9].score | 0.36992016434669495 |

| keywords[9].display_name | Economics |

| keywords[10].id | https://openalex.org/keywords/mathematics |

| keywords[10].score | 0.36005228757858276 |

| keywords[10].display_name | Mathematics |

| keywords[11].id | https://openalex.org/keywords/statistics |

| keywords[11].score | 0.2739589214324951 |

| keywords[11].display_name | Statistics |

| keywords[12].id | https://openalex.org/keywords/financial-economics |

| keywords[12].score | 0.2529639005661011 |

| keywords[12].display_name | Financial economics |

| keywords[13].id | https://openalex.org/keywords/risk-management |

| keywords[13].score | 0.15088671445846558 |

| keywords[13].display_name | Risk management |

| keywords[14].id | https://openalex.org/keywords/finance |

| keywords[14].score | 0.11811953783035278 |

| keywords[14].display_name | Finance |

| language | en |

| locations[0].id | doi:10.3390/proceedings2019033007 |

| locations[0].is_oa | True |

| locations[0].source | |

| locations[0].license | cc-by |

| locations[0].pdf_url | https://www.mdpi.com/2504-3900/33/1/7/pdf?version=1574324322 |

| locations[0].version | publishedVersion |

| locations[0].raw_type | proceedings-article |

| locations[0].license_id | https://openalex.org/licenses/cc-by |

| locations[0].is_accepted | True |

| locations[0].is_published | True |

| locations[0].raw_source_name | The 39th International Workshop on Bayesian Inference and Maximum Entropy Methods in Science and Engineering |

| locations[0].landing_page_url | https://doi.org/10.3390/proceedings2019033007 |

| locations[1].id | pmh:oai:doaj.org/article:5b4a4d807944447bb6fbae7f35f1d8ed |

| locations[1].is_oa | True |

| locations[1].source.id | https://openalex.org/S4306401280 |

| locations[1].source.issn | |

| locations[1].source.type | repository |

| locations[1].source.is_oa | False |

| locations[1].source.issn_l | |

| locations[1].source.is_core | False |

| locations[1].source.is_in_doaj | False |

| locations[1].source.display_name | DOAJ (DOAJ: Directory of Open Access Journals) |

| locations[1].source.host_organization | |

| locations[1].source.host_organization_name | |

| locations[1].license | cc-by-sa |

| locations[1].pdf_url | |

| locations[1].version | submittedVersion |

| locations[1].raw_type | article |

| locations[1].license_id | https://openalex.org/licenses/cc-by-sa |

| locations[1].is_accepted | False |

| locations[1].is_published | False |

| locations[1].raw_source_name | Proceedings, Vol 33, Iss 1, p 7 (2019) |

| locations[1].landing_page_url | https://doaj.org/article/5b4a4d807944447bb6fbae7f35f1d8ed |

| locations[2].id | pmh:oai:mdpi.com:/2504-3900/33/1/7/ |

| locations[2].is_oa | True |

| locations[2].source.id | https://openalex.org/S4306400947 |

| locations[2].source.issn | |

| locations[2].source.type | repository |

| locations[2].source.is_oa | True |

| locations[2].source.issn_l | |

| locations[2].source.is_core | False |

| locations[2].source.is_in_doaj | False |

| locations[2].source.display_name | MDPI (MDPI AG) |

| locations[2].source.host_organization | https://openalex.org/I4210097602 |

| locations[2].source.host_organization_name | Multidisciplinary Digital Publishing Institute (Switzerland) |

| locations[2].source.host_organization_lineage | https://openalex.org/I4210097602 |

| locations[2].license | cc-by |

| locations[2].pdf_url | |

| locations[2].version | submittedVersion |

| locations[2].raw_type | Text |

| locations[2].license_id | https://openalex.org/licenses/cc-by |

| locations[2].is_accepted | False |

| locations[2].is_published | False |

| locations[2].raw_source_name | Proceedings; Volume 33; Issue 1; Pages: 7 |

| locations[2].landing_page_url | https://dx.doi.org/10.3390/proceedings2019033007 |

| indexed_in | crossref, doaj |

| authorships[0].author.id | https://openalex.org/A5085355318 |

| authorships[0].author.orcid | https://orcid.org/0000-0002-6161-1898 |

| authorships[0].author.display_name | Hellinton H. Takada |

| authorships[0].countries | BR |

| authorships[0].affiliations[0].institution_ids | https://openalex.org/I17974374 |

| authorships[0].affiliations[0].raw_affiliation_string | Polytechnic School, University of São Paulo, São Paulo 05508-010, Brazil |

| authorships[0].institutions[0].id | https://openalex.org/I17974374 |

| authorships[0].institutions[0].ror | https://ror.org/036rp1748 |

| authorships[0].institutions[0].type | education |

| authorships[0].institutions[0].lineage | https://openalex.org/I17974374 |

| authorships[0].institutions[0].country_code | BR |

| authorships[0].institutions[0].display_name | Universidade de São Paulo |

| authorships[0].author_position | first |

| authorships[0].raw_author_name | Hellinton H. Takada |

| authorships[0].is_corresponding | True |

| authorships[0].raw_affiliation_strings | Polytechnic School, University of São Paulo, São Paulo 05508-010, Brazil |

| authorships[1].author.id | https://openalex.org/A5046148354 |

| authorships[1].author.orcid | |

| authorships[1].author.display_name | Sylvio X. Azevedo |

| authorships[1].countries | BR |

| authorships[1].affiliations[0].institution_ids | https://openalex.org/I17974374 |

| authorships[1].affiliations[0].raw_affiliation_string | Institute of Mathematics and Statistics, University of São Paulo, São Paulo 05508-090, Brazil |

| authorships[1].institutions[0].id | https://openalex.org/I17974374 |

| authorships[1].institutions[0].ror | https://ror.org/036rp1748 |

| authorships[1].institutions[0].type | education |

| authorships[1].institutions[0].lineage | https://openalex.org/I17974374 |

| authorships[1].institutions[0].country_code | BR |

| authorships[1].institutions[0].display_name | Universidade de São Paulo |

| authorships[1].author_position | middle |

| authorships[1].raw_author_name | Sylvio X. Azevedo |

| authorships[1].is_corresponding | False |

| authorships[1].raw_affiliation_strings | Institute of Mathematics and Statistics, University of São Paulo, São Paulo 05508-090, Brazil |

| authorships[2].author.id | https://openalex.org/A5016387967 |

| authorships[2].author.orcid | https://orcid.org/0000-0003-2720-3871 |

| authorships[2].author.display_name | Julio Michael Stern |

| authorships[2].countries | BR |

| authorships[2].affiliations[0].institution_ids | https://openalex.org/I17974374 |

| authorships[2].affiliations[0].raw_affiliation_string | Institute of Mathematics and Statistics, University of São Paulo, São Paulo 05508-090, Brazil |

| authorships[2].institutions[0].id | https://openalex.org/I17974374 |

| authorships[2].institutions[0].ror | https://ror.org/036rp1748 |

| authorships[2].institutions[0].type | education |

| authorships[2].institutions[0].lineage | https://openalex.org/I17974374 |

| authorships[2].institutions[0].country_code | BR |

| authorships[2].institutions[0].display_name | Universidade de São Paulo |

| authorships[2].author_position | middle |

| authorships[2].raw_author_name | Julio M. Stern |

| authorships[2].is_corresponding | False |

| authorships[2].raw_affiliation_strings | Institute of Mathematics and Statistics, University of São Paulo, São Paulo 05508-090, Brazil |

| authorships[3].author.id | https://openalex.org/A5028398200 |

| authorships[3].author.orcid | https://orcid.org/0000-0003-0288-2644 |

| authorships[3].author.display_name | Celma de Oliveira Ribeiro |

| authorships[3].countries | BR |

| authorships[3].affiliations[0].institution_ids | https://openalex.org/I17974374 |

| authorships[3].affiliations[0].raw_affiliation_string | Polytechnic School, University of São Paulo, São Paulo 05508-010, Brazil |

| authorships[3].institutions[0].id | https://openalex.org/I17974374 |

| authorships[3].institutions[0].ror | https://ror.org/036rp1748 |

| authorships[3].institutions[0].type | education |

| authorships[3].institutions[0].lineage | https://openalex.org/I17974374 |

| authorships[3].institutions[0].country_code | BR |

| authorships[3].institutions[0].display_name | Universidade de São Paulo |

| authorships[3].author_position | last |

| authorships[3].raw_author_name | Celma O. Ribeiro |

| authorships[3].is_corresponding | False |

| authorships[3].raw_affiliation_strings | Polytechnic School, University of São Paulo, São Paulo 05508-010, Brazil |

| has_content.pdf | True |

| has_content.grobid_xml | True |

| is_paratext | False |

| open_access.is_oa | True |

| open_access.oa_url | https://www.mdpi.com/2504-3900/33/1/7/pdf?version=1574324322 |

| open_access.oa_status | gold |

| open_access.any_repository_has_fulltext | False |

| created_date | 2019-12-05T00:00:00 |

| display_name | Using Entropy to Forecast Bitcoin’s Daily Conditional Value at Risk |

| has_fulltext | True |

| is_retracted | False |

| updated_date | 2025-11-06T03:46:38.306776 |

| primary_topic.id | https://openalex.org/T11059 |

| primary_topic.field.id | https://openalex.org/fields/20 |

| primary_topic.field.display_name | Economics, Econometrics and Finance |

| primary_topic.score | 0.9987000226974487 |

| primary_topic.domain.id | https://openalex.org/domains/2 |

| primary_topic.domain.display_name | Social Sciences |

| primary_topic.subfield.id | https://openalex.org/subfields/2002 |

| primary_topic.subfield.display_name | Economics and Econometrics |

| primary_topic.display_name | Market Dynamics and Volatility |

| related_works | https://openalex.org/W4301377905, https://openalex.org/W2408851247, https://openalex.org/W2232143283, https://openalex.org/W2950198523, https://openalex.org/W2096554740, https://openalex.org/W3122839946, https://openalex.org/W799577184, https://openalex.org/W2016139756, https://openalex.org/W2031780815, https://openalex.org/W2594064876 |

| cited_by_count | 4 |

| counts_by_year[0].year | 2022 |

| counts_by_year[0].cited_by_count | 2 |

| counts_by_year[1].year | 2021 |

| counts_by_year[1].cited_by_count | 1 |

| counts_by_year[2].year | 2020 |

| counts_by_year[2].cited_by_count | 1 |

| locations_count | 3 |

| best_oa_location.id | doi:10.3390/proceedings2019033007 |

| best_oa_location.is_oa | True |

| best_oa_location.source | |

| best_oa_location.license | cc-by |

| best_oa_location.pdf_url | https://www.mdpi.com/2504-3900/33/1/7/pdf?version=1574324322 |

| best_oa_location.version | publishedVersion |

| best_oa_location.raw_type | proceedings-article |

| best_oa_location.license_id | https://openalex.org/licenses/cc-by |

| best_oa_location.is_accepted | True |

| best_oa_location.is_published | True |

| best_oa_location.raw_source_name | The 39th International Workshop on Bayesian Inference and Maximum Entropy Methods in Science and Engineering |

| best_oa_location.landing_page_url | https://doi.org/10.3390/proceedings2019033007 |

| primary_location.id | doi:10.3390/proceedings2019033007 |

| primary_location.is_oa | True |

| primary_location.source | |

| primary_location.license | cc-by |

| primary_location.pdf_url | https://www.mdpi.com/2504-3900/33/1/7/pdf?version=1574324322 |

| primary_location.version | publishedVersion |

| primary_location.raw_type | proceedings-article |

| primary_location.license_id | https://openalex.org/licenses/cc-by |

| primary_location.is_accepted | True |

| primary_location.is_published | True |

| primary_location.raw_source_name | The 39th International Workshop on Bayesian Inference and Maximum Entropy Methods in Science and Engineering |

| primary_location.landing_page_url | https://doi.org/10.3390/proceedings2019033007 |

| publication_date | 2019-11-21 |

| publication_year | 2019 |

| referenced_works | https://openalex.org/W1647779468, https://openalex.org/W2488157181, https://openalex.org/W6633915922, https://openalex.org/W3124407081, https://openalex.org/W2039622329, https://openalex.org/W2034426848, https://openalex.org/W2078764315, https://openalex.org/W2616064665, https://openalex.org/W3121560716, https://openalex.org/W2912834344, https://openalex.org/W2810297868, https://openalex.org/W3121899294, https://openalex.org/W2938464877, https://openalex.org/W3081279040, https://openalex.org/W2141514928, https://openalex.org/W1995875735, https://openalex.org/W4241653265, https://openalex.org/W2801665420, https://openalex.org/W2808843567, https://openalex.org/W1563767941 |

| referenced_works_count | 20 |

| abstract_inverted_index.a | 9, 45, 61, 65, 161 |

| abstract_inverted_index.In | 68, 112 |

| abstract_inverted_index.On | 87 |

| abstract_inverted_index.We | 142 |

| abstract_inverted_index.an | 52, 98 |

| abstract_inverted_index.as | 24, 97 |

| abstract_inverted_index.at | 2, 38 |

| abstract_inverted_index.in | 64, 80, 101, 104 |

| abstract_inverted_index.is | 8, 34, 44, 76, 147 |

| abstract_inverted_index.of | 28, 119, 122, 153, 156, 171, 179, 189 |

| abstract_inverted_index.on | 166 |

| abstract_inverted_index.or | 5 |

| abstract_inverted_index.to | 15, 78, 83, 106, 150, 173 |

| abstract_inverted_index.we | 115, 133 |

| abstract_inverted_index.The | 42 |

| abstract_inverted_index.VaR | 43, 79 |

| abstract_inverted_index.and | 17, 20, 71, 132, 168 |

| abstract_inverted_index.day | 182 |

| abstract_inverted_index.for | 12 |

| abstract_inverted_index.has | 94 |

| abstract_inverted_index.how | 50 |

| abstract_inverted_index.the | 25, 32, 36, 88, 91, 108, 117, 126, 139, 145, 151, 169, 175, 180, 186, 190 |

| abstract_inverted_index.use | 170, 188 |

| abstract_inverted_index.CVaR | 23, 75, 137, 167, 178 |

| abstract_inverted_index.VaR. | 111 |

| abstract_inverted_index.and, | 103 |

| abstract_inverted_index.been | 95 |

| abstract_inverted_index.find | 143 |

| abstract_inverted_index.lose | 55 |

| abstract_inverted_index.loss | 29, 33 |

| abstract_inverted_index.much | 51 |

| abstract_inverted_index.next | 181 |

| abstract_inverted_index.risk | 3, 10, 39, 46 |

| abstract_inverted_index.show | 73 |

| abstract_inverted_index.than | 185 |

| abstract_inverted_index.that | 31, 48, 74, 144 |

| abstract_inverted_index.this | 113 |

| abstract_inverted_index.time | 66, 128 |

| abstract_inverted_index.used | 96 |

| abstract_inverted_index.with | 60 |

| abstract_inverted_index.(VaR) | 40 |

| abstract_inverted_index.CVaR. | 192 |

| abstract_inverted_index.Yamai | 19 |

| abstract_inverted_index.based | 165 |

| abstract_inverted_index.daily | 110, 136, 158, 177 |

| abstract_inverted_index.given | 30, 62 |

| abstract_inverted_index.hand, | 90 |

| abstract_inverted_index.might | 54 |

| abstract_inverted_index.model | 164 |

| abstract_inverted_index.naive | 187 |

| abstract_inverted_index.other | 89 |

| abstract_inverted_index.using | 138, 160 |

| abstract_inverted_index.usual | 57 |

| abstract_inverted_index.value | 1, 37 |

| abstract_inverted_index.(STSA) | 131 |

| abstract_inverted_index.better | 184 |

| abstract_inverted_index.beyond | 35 |

| abstract_inverted_index.define | 22 |

| abstract_inverted_index.during | 56 |

| abstract_inverted_index.level. | 41 |

| abstract_inverted_index.market | 58 |

| abstract_inverted_index.paper, | 114 |

| abstract_inverted_index.series | 129 |

| abstract_inverted_index.values | 155 |

| abstract_inverted_index.(CVaR), | 4 |

| abstract_inverted_index.Shannon | 92 |

| abstract_inverted_index.Uryasev | 72 |

| abstract_inverted_index.Yoshiba | 21 |

| abstract_inverted_index.entropy | 93, 118, 146, 172 |

| abstract_inverted_index.extreme | 154 |

| abstract_inverted_index.measure | 11, 47, 100 |

| abstract_inverted_index.related | 82 |

| abstract_inverted_index.through | 125 |

| abstract_inverted_index.Uryasev. | 18 |

| abstract_inverted_index.analysis | 130 |

| abstract_inverted_index.entropy. | 141 |

| abstract_inverted_index.estimate | 116 |

| abstract_inverted_index.expected | 6 |

| abstract_inverted_index.forecast | 107, 134, 174 |

| abstract_inverted_index.intraday | 120 |

| abstract_inverted_index.logistic | 162 |

| abstract_inverted_index.performs | 183 |

| abstract_inverted_index.superior | 77 |

| abstract_inverted_index.symbolic | 127 |

| abstract_inverted_index.according | 14 |

| abstract_inverted_index.estimated | 140 |

| abstract_inverted_index.interval. | 67 |

| abstract_inverted_index.portfolio | 85 |

| abstract_inverted_index.conditions | 59 |

| abstract_inverted_index.correlated | 149 |

| abstract_inverted_index.historical | 191 |

| abstract_inverted_index.investment | 53, 84 |

| abstract_inverted_index.likelihood | 152 |

| abstract_inverted_index.logreturns | 124, 159 |

| abstract_inverted_index.positively | 148 |

| abstract_inverted_index.regression | 163 |

| abstract_inverted_index.represents | 49 |

| abstract_inverted_index.shortfall, | 7 |

| abstract_inverted_index.Conditional | 0 |

| abstract_inverted_index.Rockafellar | 16, 70 |

| abstract_inverted_index.conditional | 26 |

| abstract_inverted_index.expectation | 27 |

| abstract_inverted_index.investments | 13, 102 |

| abstract_inverted_index.particular, | 69, 105 |

| abstract_inverted_index.probability | 63 |

| abstract_inverted_index.uncertainty | 99 |

| abstract_inverted_index.applications | 81 |

| abstract_inverted_index.distribution | 121 |

| abstract_inverted_index.optimization. | 86 |

| abstract_inverted_index.Bitcoin’s | 109, 123, 135, 157, 176 |

| cited_by_percentile_year.max | 96 |

| cited_by_percentile_year.min | 89 |

| corresponding_author_ids | https://openalex.org/A5085355318 |

| countries_distinct_count | 1 |

| institutions_distinct_count | 4 |

| corresponding_institution_ids | https://openalex.org/I17974374 |

| sustainable_development_goals[0].id | https://metadata.un.org/sdg/9 |

| sustainable_development_goals[0].score | 0.47999998927116394 |

| sustainable_development_goals[0].display_name | Industry, innovation and infrastructure |

| citation_normalized_percentile.value | 0.89272101 |

| citation_normalized_percentile.is_in_top_1_percent | False |

| citation_normalized_percentile.is_in_top_10_percent | True |