Solvency: Models, Assessment and Regulation Article Swipe

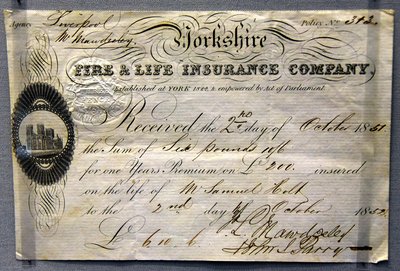

Introduction General Outline of the Book Organizations A Selection of Solvency Readings Solvency: What Is It? In the 18th Century What Does Solvency Mean? PAST AND PRESENT: A HISTORICAL REVIEW AND DIFFERENT APPROACHES TO SOLVENCY The European Union: Solvency 0 and Accounting The Works of Campagne Other Steps toward the First Directives The Non-Life Directives (First, Second, and Third) The Life Directives (First, Second, and Third) Calculating the Solvency Margin for Non-Life Insurance Business The Insurance Accounting Directive (IAD) The European Union: Solvency I The Muller Report Comments from Groupe Consultatif The Solvency I Directives Calculating the Solvency Margin for Non-Life Insurance Business Steps toward Solvency II: Bank for International Settlements (BIS): The New Basel Capital Accord IASB: Toward a New Accounting System IAIS: Insurance Principles and Guidelines IAA: A Global Framework for Solvency Assessment EU: Solvency II - Phase I Steps toward Solvency II: 2 Australia Canada Denmark Finland The Netherlands Singapore Sweden Switzerland U.K. U.S. Some Other Systems Summary of Different Systems PRESENT: MODELING A STANDARD APPROACH The Fundamental Ideas A Model for the Solvency Assessment Level of Capital Requirements Risks and Diversification Risk Measures Valuations Fair Value: Introduction Purposes of Valuation Best Estimate of Insurance Liability and Technical Provisions Fair Value Dependencies, Baseline, and Benchmark Models Risk Measures Assume Normality Assume Nonnormality Correlations between Risks: Different Levels of Conservatism Parameters in a Factor-Based Model One Example of Risk Categories and Diversification Insurance Risk Market Risk Credit Risk Operational Risk Liquidity Risk Dependency A Proposal for a Standard Approach: From Formula to Spreadsheet The Insurance Risk, CIR Market Risk, CMR Credit Risk, CCR Operational Risk, COR The Total Factor-Based Model A Spreadsheet Approach Parameter Estimates An Example PART C PRESENT AND FUTURE: EU SOLVENCY II - PHASE 2: GROUPS AND INTERNAL MODELING IN BRIEF The European Union: Reinsurance, Insurance Groups, and Financial Conglomerates Reinsurance Insurance Groups and Financial Conglomerates The European Union: Solvency II - Phase II Recommendations for the First Pillar Recommendations for the Second Pillar Recommendations for the Third Pillar General Considerations The First Wave of Requests (Pillar II) The Second Wave of Requests Will Include the Following Issues (Pillar I) The Third Wave of Requests Will Include the Following Issues (Pillar III) A Brief Summary Further Steps Internal Models and Risk Management Forecasting the Future and Risk Management APPENDICES Appendix A Proposal for a Standard Approach: One Step toward Application Insurance Risk Market Risk Credit Risk Operational Risk Appendix B Insurance Classes Non-Life Classes Life Classes Appendix C From the Non-Life Directives Solvency 0 Solvency I Appendix D From the Life Directives Solvency 0 Solvency I Appendix E IAIS: Insurance Principles, Standards, and Guidelines Principles Standards Guidances Appendix F From the Proposed Reinsurance Directive Chapter 3: Rules Relating to the Solvency Margin and to the Guarantee Fund Appendix G Annex I and Annex II in the Insurance Group Directive Annex I : Calculation of the Adjusted Solvency of Insurance Undertakings Annex II: Supplementary Supervision for Insurance Undertakings That Are Subsidiaries of an Insurance Holding Company, a Reinsurance Undertaking or a Non-Member-Country Insurance Undertaking Appendix H From the Financial Conglomerates Directive Amendments to the Non-Life Directive Made (EEC, 1973) Amendments to the Life Directive (EEC, 1979) Amendments to the Insurance Group Directive (COM, 1998) Annex I: Capital Adequacy Appendix I Prudent Person Rule Article 18: Investment Rules