Risk management in multi-objective portfolio optimization under uncertainty Article Swipe

YOU?

·

· 2024

· Open Access

·

· DOI: https://doi.org/10.48550/arxiv.2407.19936

YOU?

·

· 2024

· Open Access

·

· DOI: https://doi.org/10.48550/arxiv.2407.19936

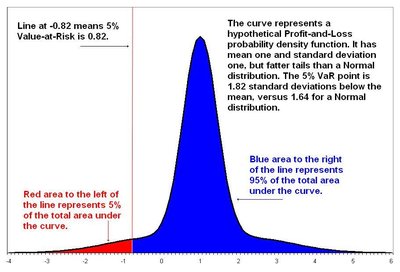

In portfolio optimization, decision makers face difficulties from uncertainties inherent in real-world scenarios. These uncertainties significantly influence portfolio outcomes in both classical and multi-objective Markowitz models. To address these challenges, our research explores the power of robust multi-objective optimization. Since portfolio managers frequently measure their solutions against benchmarks, we enhance the multi-objective min-regret robustness concept by incorporating these benchmark comparisons. This approach bridges the gap between theoretical models and real-world investment scenarios, offering portfolio managers more reliable and adaptable strategies for navigating market uncertainties. Our framework provides a more nuanced and practical approach to portfolio optimization under real-world conditions.

Related Topics To Compare & Contrast

- Type

- preprint

- Language

- en

- Landing Page

- http://arxiv.org/abs/2407.19936

- https://arxiv.org/pdf/2407.19936

- OA Status

- green

- Cited By

- 1

- Related Works

- 10

- OpenAlex ID

- https://openalex.org/W4401202342