Explanipedia Public Learning Modules Vs Mis Dis Mal Information:

Description

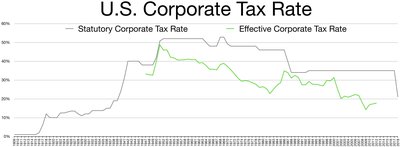

A C corporation , under United States federal income tax law, is any corporation that is taxed separately from its owners. A C corporation is distinguished from an S corporation, which generally is not taxed separately. Many companies, including most major corporations, are treated as C corporations for U.S. federal income tax purposes. C corporations and S corporations both enjoy limited liability, but only C corporations are subject to corporate income taxation.

C Corporation News

Loading news…

Tags

Responsibility

(18.5K)

Justice

(18.1K)

Fairness

(12.3K)

Equality

(11.2K)

Cooperation

(10.7K)

Empowerment

(10.0K)

Community

(7,302)

Solidarity

(2,870)

Business

(2,175)

Finance

(1,663)

Management

(662)

Capitalism

(619)

Exploitation

(536)

Company

(309)

Office

(230)

Corporate

(200)

Wealthinequality

(137)

Corporategovernance

(52)

Economicinjustice

(6)

Collections

No collections available for this topic.