Explanipedia Public Learning Modules Vs Mis Dis Mal Information:

Description

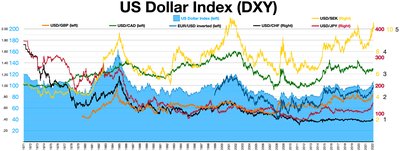

A hedge is an investment position intended to offset potential losses or gains that may be incurred by a companion investment. A hedge can be constructed from many types of financial instruments, including stocks, exchange-traded funds, insurance, forward contracts, swaps, options, gambles, many types of over-the-counter and derivative products, and futures contracts.

Public futures markets were established in the 19th century to allow transparent, standardized, and efficient hedging of agricultural commodity prices; they have since expanded to include futures contracts for hedging the values of energy, precious metals, foreign currency, and interest rate fluctuations.

Hedge (Finance) News

Loading news…

Tags

Reliability

(25.8K)

Determination

(24.9K)

Integrity

(18.7K)

Trust

(14.8K)

Commitment

(14.8K)

Confidence

(12.4K)

Fairness

(12.3K)

Cleanliness

(11.3K)

SelfDiscipline

(10.8K)

Caring

(10.1K)

Excellence

(9,544)

Accuracy

(3,496)

Protection

(2,246)

Finance

(1,663)

Economy

(1,545)

Investment

(1,069)

Risk

(959)

WealthInequality

(418)

Investing

(151)

Collections

No collections available for this topic.